How to Revive Japan’s Economy

The Board Director Training Institute of Japan (BDTI) is the most influential provider of director training and data on corporate governance in Japan. I am pleased to share this report on the growth of our activities during FY2021 (please click). Notably, more than 32% of our participants in non-corporate programs were women.

While our training activity has increased, we are still dependent on donations from foreign investors for our survival so that we may continue to make an outsized impact in improving corporate governance in Japan. For the past few years, I have reduced my own salary to a minimal level to make this possible. (In fact, over the past 12 years, after subtracting my own donations to BDTI, I have literally worked for zero compensation.)

BDTI is regulated by the Japanese government. I intentionally created BDTI in 2009 as a non-profit and later obtained special government certification that its director training activities serve the “public interest”, to create the most eminently “supportable” platform for spreading governance best practices and the custom of director training in Japan. Especially after I proposed the Corporate Governance Code to the government in 2013 (which requires director training), I believed that this format would make it easy for Japanese institutional investors to support our activities, in view of their responsibilities under the Stewardship Code and their proclaimed dedication to ESG and sustainability. After all, the quality of “G” (the board) is the pillar that ensures whether “E” and “S” will create value for shareholders, stakeholders, and society over the long term, rather than simply as reactive PR.

However, during the past 12 years, not a single large Japanese investing institution has supported BDTI or cooperated with our activities in any way, despite many meetings. Instead, 99% of BDTI’s donations have come from foreign asset managers and institutions, including some of the most respected investing organizations in the world.

Managing Human Resources in the Age of VUCA and Diversity — Advice from Levent Arabaci, Former CTRO at Hitachi

Here in Japan, Hitachi has been a leader in this area under the leadership of the late CEO Hiroaki Nakanishi and Levent Arabaci, who until recently served as Chief Transformation Officer (CTRO) for Global Operations, and previously was the EVP of Human Resources starting in 2012.

In this webinar, Mr. Arabaci will describe the range of modern HR practices that Hitachi has put in place during the past 10 years, spanning areas such as talent mapping, career planning and development, performance evaluations, practices for promotions, and increases in diversity. BDTI Representative Director Nicholas Benes will interview Mr. Arabaci to identify the biggest challenges Hitachi has faced, and to reveal his concrete advice as to how other Japanese companies can overcome similar challenges.

Next, we will be joined by Takeo Yamaguchi (ex-Hitachi) and Christiane Iwanoff of Olympus, two persons with extensive experience at HR management. The panel participants will share their experiences and perspectives, will consider additional issues that have arisen in recent years, such as the impact of WFH, addressing work-life balance, and building more diverse, innovative organizations.

Date: June 1, 2022(Wed.) 12:00-14:30

Location: Zoom Web Conference

Charge: Free

METRICAL:How far has corporate governance progressed in 2021(3)

Following on from my previous articles “How far has corporate governance progressed in 2021 (1)” and “How far has corporate governance progressed in 2021 (2),” I would like to take a look at how far efforts to improve corporate governance at listed companies have progressed in 2021. In this article, I would like to look at how much progress has been made by listed companies in improving corporate governance in 2021.

To briefly summarize the previous two articles, with regard to board practices, I reported that there was little improvement or only limited improvement in the evaluation items that were not specifically mentioned for improvement in the revised Corporate Governance Code, such as board chairmanship, female directors, and anti-takeover measures. In terms of key actions actually taken by listed companies, I reported that the effective use of cash and policy holdings and the clear articulation of growth strategies are likely to continue to be issues this year. Considering the fact that the percentage of foreign shareholders has slightly decreased while stock prices and valuations have risen, I can conclude that the effective use of cash and assets with growth potential may still be an issue, as it may be related to the sluggish growth of ROE and ROA.

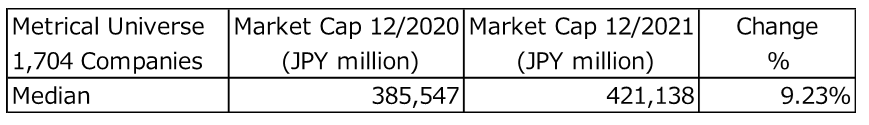

This article will be analyzed in terms of how much each company’s market capitalization has grown. The table below shows the change in market capitalization of the 1,704 companies in the Metrical Universe that are comparable in December 2020 and December 2021. The median market capitalization of the 1,704 companies in the Metrical Universe as of December 2020 was 385,547 million yen, and the median market capitalization of the 1,704 companies in the Metrical Universe as of December 2020 increased to 421,138 million yen, an increase of 9.23% over one year.

The table below shows the median ROE and ROA of the 1,704 companies in the metrical universe as of December 2020 and December 2021. Since ROE and ROA are averages of the past three years, ROE and ROA as of December 2020 are slightly lower than the previous year, reflecting the performance of FY2020, which was significantly affected by the COVID-19 pandemic. Tobin’s q, on the other hand, has been rising on the back of higher stock prices.

BDTI FY2021 Update to Supporters

Activities and Milestones

Training Activities

- BDTI trained 342 persons in director training programs, broken down as follows:

▸ 122 in our three programs to which anyone can apply (13 programs)

◦ 32 in our new “advanced” course, focusing on the role of outside directors

◦ 16 in a joint course that included a section on diversity management

▸ 169 were trained in programs that were customized for specific corporations

◦ 64 of these were in programs where executives at subsidiaries received training

▸ 32% of the participants in our non-corporate director training programs were women, more than four times the average % of female directors on Japanese boards. This figure will likely increase in FY2022 because of a generous sponsored program to fund “training scholarships” for women - 608 persons attended our seven BDTI webinars, in which leading experts focused on these topics:

▸ “Understanding D&O insurance”

▸ “Engagement by investors – recent techniques”

▸ “Collective engagement in Japan: issues and obstacles”

▸ “ESG management” and “ESG disclosure”

▸ “Effective dialogue with investors, and the use of analyses and letters”

▸“The market for corporate control, and takeover defenses”

▸ “Factors affecting the selection of the legal form of governance” (from among the three types) - Upcoming webinars include an update on the ISSB’s direction, and global HR management.

- At least 3,000 persons either received (or had access to) BDTI’s four e-Learning modules, including two megabanks and multiple corporate groups using our “unrestricted use” package

“Missionary Work” – Updating Institutional Investors

- I gave 14 speeches to different groups, comprising both Japanese and foreign institutional investors groups, adding up to a total “audience” of approximately 1,620 persons

Consulting and Data Activities – Now Starting to Contribute to BDTI’ s Long-term Sustainability

- BDTI conducted consulting assignments for, or sold data to, 29 counterparties

- Sold GoToData Dashboard service (demo it here: https://gotodata.jp/demo/home.php )

- Sold direct access to BDTI’s detailed database with unique data and text to major institutions