Mr. Ghosn’s criminal cases are ongoing. But the criminal cases alone will not put a close to this entire ordeal. It is a matter of time for Nissan to face civil cases filed by investors. Due to Mr. Ghosn’s understated compensation, it is anticipated that a considerable amount of assets will flow out of Nissan. The largest part of this outflow will be accounted for the damages claimed by and awarded to investors in civil lawsuits. What amount of assets will flow out of Nissan? This memo is an attempt to estimate the probable size of these damages.

The major legal basis used by plaintiffs/investors will be the Article 21-2 of the Financial Instruments and Exchange Act, which reads as follows:

” Article 21-2 (1) – If any of the documents specified in the items of Article 25 (1) contains any untrue statement on material matters or lacks a statement on material matters that should be stated or on a material fact that is necessary for avoiding misunderstanding, the person who submitted the document shall be held liable to compensate a person who, during the period when the document was made available for public inspection as required by Article 25 (1), purchases the Securities issued by the person who submitted the document, not through Public Offering or Secondary Distribution for damage arising from the untrue statement or lack of a required statement (hereinafter collectively referred to as a “Untrue Statement, etc.” in this Article), to the extent not exceeding the amount calculated according to the same rule as provided in Article 19 (1); provided, however, that this shall not apply when the person who purchases the Securities had known of the existence of a Untrue Statement, etc. at the time of the purchase.

Article 21-2 (2) – In the case referred to in the main clause of the preceding paragraph, when public disclosure of the Untrue Statement, etc. is made, with regard to a person who purchased the Securities within one year prior to the day when the Untrue Statement, etc. is publicly disclosed (hereinafter referred to as the “Disclosure Date” in this paragraph) and continues to hold the Securities at the Disclosure Date, the amount calculated by deducting the average market value during one month after the Disclosure Date from the average market value during one month prior to the Disclosure Date may be presumed as the amount of damage.”

In Paragraph (2), the burden of proof is shifted to the defendant, and the law presumes the per-share damages to be the difference between the one-month average stock price before the disclosure date and the one-month average stock price after the disclosure date. Unless the defendant can prove that it was not negligent, or even if so, that the true amount of damages should be different, it will have to pay this amount of damages to plaintiffs.

Which day is going to be considered to be the “Disclosure Date” in the Nissan case? November 19th, 2018, the day when Mr. Ghosn was arrested, is a fair guess. On that day, it was widely reported that Mr. Ghosn’s compensation amount was understated and there was an untrue statement in the securities report. In the Livedoor case as well, the date when the CEO was arrested date was set as the Disclosure Date.

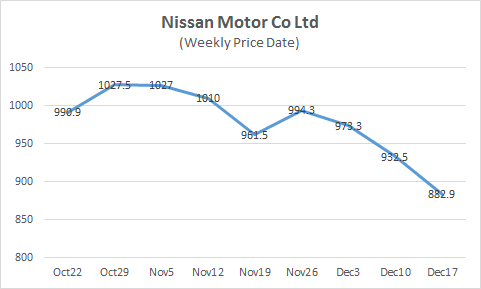

During the one-month period before and after the Disclosure Date of November 19th, 2018, Nissan’s stock price has traded approximately as follows (weekly price data; last date in the chart is November 17th):

According to these trends and calculating based on the December 19th closing price, the “presumed damages” per share will be JPY53.11 The remaining factors required for calculation are the number of shares purchased by investors during the year before the Disclosure Date, and the number of shares still held by investors on the Disclosure Date. These are unknown until the plaintiffs prove the fact of purchase and possession after they sue. Therefore, the only way to pursue calculation attempt is to use certain assumptions.

So I set the trading volume of the year from November 2017 to October 2018 as a base, and divided it by four, assuming that half of the investors who purchased shares continued to hold until the Disclosure Date, and half of those who have continued holding until the Disclosure Date will file a lawsuit.

According to these assumptions, I calculated the (roughly) expected damages to be JPY46 billion. We should anticipate that the assets equivalent to JPY46 billion will flow out of Nissan because of these civil lawsuits. Actually, one should anticipate that plaintiffs’ total claims will exceed JPY46 billion. This is because Article 21-2 is not the only Article of the Securities Law that plaintiffs can use, but other Articles and other legal arguments can also be used. Investors can also file lawsuits against individuals such as Mr. Ghosn and other directors and corporate auditors, as defendants. However, the convenience of Article 21-2 Provision (2) for plaintiffs will make Nissan (the corporation) more vulnerable than those individual defendants.

The following provides a point of reference. When I made this calculation for the Olympus case using the same assumptions as above, the presumed damages amount was JPY62.4 billion. Special consideration was needed due to the fact that the CEO had been dismissed just before the Disclosure Date. As things turned out, it was reported by media that the total amount of money actually demanded by investors was about JPY86 billion. It was also reported that a series of lawsuits were wound up in December 2018, and the final total of all settlement payments was JPY45 billion.

When I made this calculation for the Toshiba case using the same assumptions as above, the presumed amount was JPY94 billion. It should be noted, however, that Toshiba’s situation is more complex, and has multiple candidate dates for the Disclosure Date. Toshiba has announced that claims totaling about JPY173 billion filings had been made as of December 2017.

(End)