”Sharp on Thursday became Japan’s first major electronics maker to be acquired by a foreign company.

Month: February 2016

”3 factors driving better corporate governance”

”Around the world, the corporate governance landscape is shifting, as efforts to improve business practices and policies gain support and momentum. The wave of reform has become visible everywhere – from tough new regulations in Japan to sovereign wealth funds like Norway’s Norges Bank Investment Management taking a more active approach to their investments – and it is certain to continue to rise.

”Against the tide”

A UK perspective on corporate governance issues.

John McFarlane talks to Governance and Compliance about the misplaced value in bonus culture and why the board must be sceptical

Kentaro et al: ”How Inclusive is Abenomics?”

Figure: 1 Gini before Taxes and Transfers (Market Income)

“In the last two years, Japan has embarked on an ambitious effort, the so-called Abenomics approach, to decisively get the economy out of deflation and revive growth. At the same time, policymakers and academics from all over the world are engaging in a global debate on inequality.

Investor ESG: ”What You Need To Know About Fink’s Quiet Earthquake”

Greenwald: ”Will Japan’s corporate governance reform work?”

”As part of Abenomics’ third arrow of structural reform, Japan recently adopted a new corporate governance code. The new code focuses on making Japanese corporations more transparent, more responsive to shareholders — including minority shareholders — and subject to more effective oversight by boards of directors, especially outside directors. It seeks to make boards […]

”Executive Women Symposium Reception”

Photograph of the Prime Minister delivering an address

”Prime Minister Shinzo Abe attended the Executive Women Symposium Reception held in Tokyo.

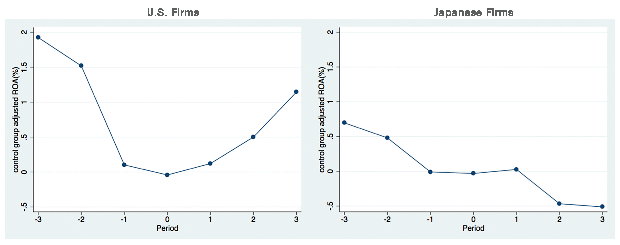

”Poor Earning Power of Japanese Firms” (picture=1000 words)

Figure 2: Return on Assets Before and After Corporate Leadership Change

Hyeog Ug Kwon, Faculty Fellow, RIETI: ”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power.

Time: ”Japan Is a Disturbing Cautionary Tale for America and the World”

”This is what happens when economies rely on easy money but don’t follow through with the hard work of reform.

If ever there was a country that illustrates the bizarre economic conditions the world finds itself in, it’s Japan.

Usually, when a country’s central bank cuts interest rates, its currency weakens on the global stage, making it easier to sell goods and services abroad as well as providing incentives for banks to lend. Both are supposed to increase economic growth. Except nothing is working like it’s supposed to these days in the global economy, and Japan is the number one case in point.

The Nikkei: ”Record dividends could boost stocks, consumption”

”Listed Japanese companies are on track for a third-straight year of record dividend payouts, with the figure set to hit 10.8 trillion yen ($93.38 billion), topping the 10 trillion yen mark for the first time.