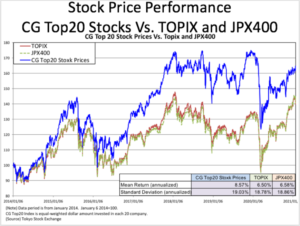

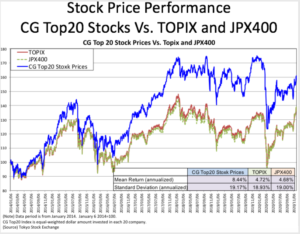

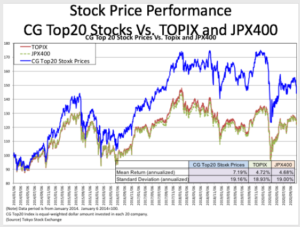

May stock market continued directionless trading after an upturn at the beginning of the month. CG Top 20 stocks outperformed against both the Topix and JPX400 indices.

Stock prices opened higher at the beginning of the month on the back of lower US interest rates led by lower-than-expected US employment data, but subsequently kept directionless trading. Topix and JPX400 indices gained 1.42% and 1.78%, respectively, during the month of May. The CG Top 20 stocks outperformed for the second consecutive month with a 2.17% gain.