IRRC INSTITUTE New Report by Annalisa Barrett, Founder and CEO of Board Governance Research LLC. Successful CEO transitions Correlate with More Robust Disclosure, but Succession Planning Disclosure Frequently is Non Existent and Often Inconsistent – A US perspective Executive Summary: ”Shareowners and other stakeholders have been calling for more information about CEO succession planning. This […]

Category: Management

”The 100 Most Overpaid CEOs: Take Action”

Harvard Business Review ”Heresy! Stop Paying CEOs Performance Bonuses”

”For Harvard Business Review to advise companies to stop paying executives based on performance is like your local church telling parishioners to stop dropping money in the collection basket. Yet there it is, in an article published on the magazine’s website Feb. 23: “Performance-based pay can actually have dangerous outcomes for companies that implement it.”

Lest there be any mistake, the article goes on to say, “We argue in favor of abolishing pay-for-performance for top managers altogether. We propose that, instead, most firms should pay their top executives a fixed salary.”

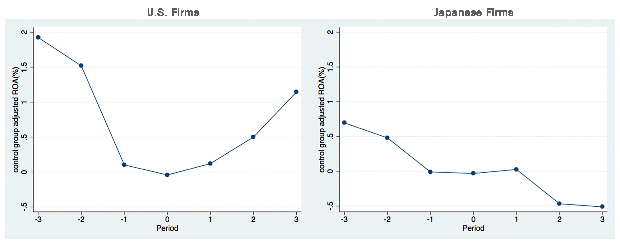

Prof. Kwon’s Research: Replace CEO in US, ROA Improves; Replace in Japan, It Does Not

”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power.

BBC on the Bottom Line – Managing the Boardroom

A UK perspective – Managing the Boardroom (Audio) – ”After recent corporate scandals like VW’s emissions’ cheating, Tesco’s accounting irregularities, Barclays interest-rate rigging, many asked why company board members failed to act.

How companies succeed through radical engagement | McKinsey & Company

“The authors of Connect: How Companies Succeed by Engaging Radically with Society explain why organizations must look beyond corporate-social-responsibility initiatives to truly engage with consumers and communities.

Antibusiness sentiment is nothing new. Yet mending the rift between big business and society isn’t merely a worthy goal—it may represent a new frontier of competitive advantage, profitability, and longevity for today’s organizations. In Connect: How companies succeed by engaging radically with society (PublicAffairs, March 2016), L1 Energy chairman and former BP chief executive officer John Browne, McKinsey’s Robin Nuttall, and entrepreneur Tommy Stadlen offer a practical blueprint for reconciling companies and communities.

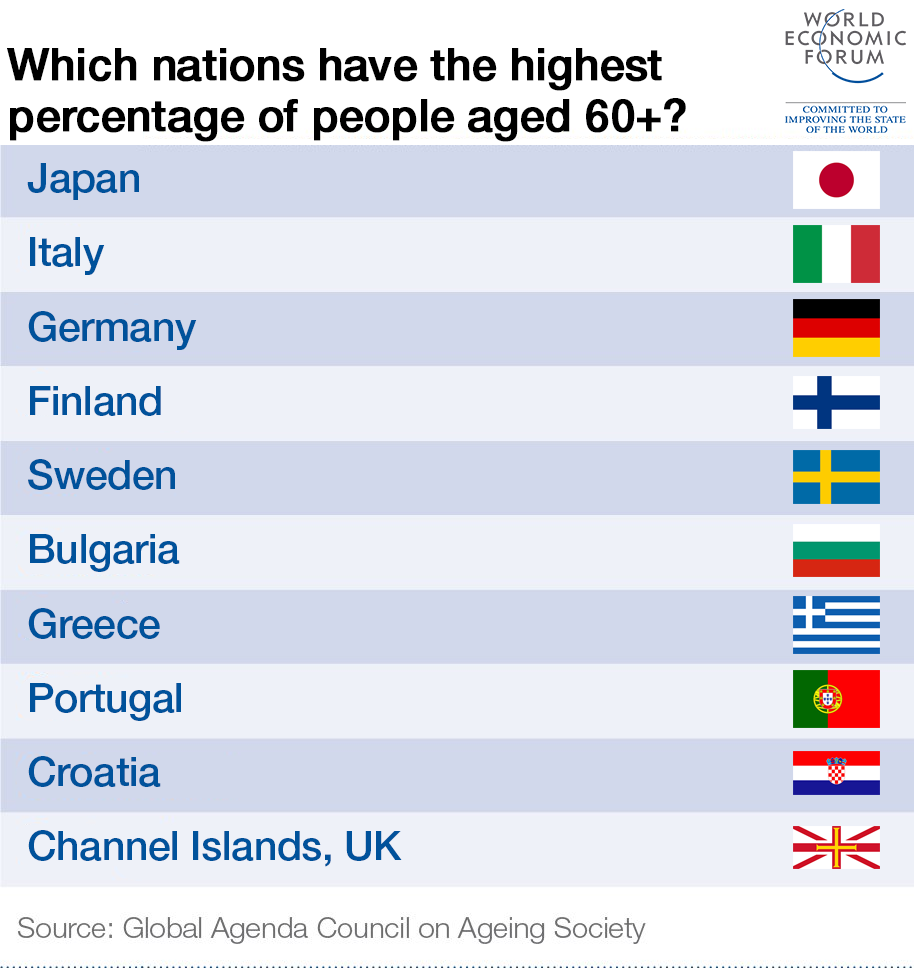

WEF: ”Japan’s population is shrinking: What does it mean for the economy?”

Now at 127 million, Japan’s population is forecast to fall to about 83 million by 2100

”Japan’s population has fallen by nearly 1 million in the past five years, in the first decline since the census began in 1920. This is bad news for the country’sshrinking economy, which is unable to depend on an expanding labour force to drive growth.

”Prosecutorial Bent Shows in SEC Accounting-Fraud Push, Ex-Official Says”

Mary Jo White, chair of the U.S. Securities and Exchange Commission, speaks at The Economic Club of New York, in Manhattan, June 20, 2014

”The Securities and Exchange Commission’s push to step up policing of accounting fraud could have a lasting impact on the agency’s work, bringing more cases related to poor internal controls and more actions against individuals, a top former official said.

”Foxconn Hesitates on $5.5 Billion Bid for Sharp”

Kozo Takahashi, the president of Sharp, on Thursday.

”TOKYO — For a few hours on Thursday, it looked as if Sharp, the ailing Japanese consumer electronics company, had secured a $5.5 billion takeover from Foxconn of Taiwan, the giant contract manufacturer that churns out products for Apple and other foreign brands.

Then things took a left turn.

”The Shifting Sands of Board Dynamics”

Reflections & Ideas by Chris Clarke

”Greetings. As President & CEO of Boyden global executive search, I shall take a liberty and put forth some of my personal views and thoughts. These are personal opinions, based on my own knowledge, experience and recent research. They do not reflect those of our organization.

Like sand dunes in the desert, Boards of Directors are blown this way and that by winds of change. The bursting of the dot com bubble and the scandals of ENRON and others led to Sarbox and all its unintended consequences. Worst of all, despite the costs and restrictions imposed on corporations by the legislature, Sarbox did not prevent the problems raised by the recent financial crisis.