Such fines have occasionally sparked a debate about whether corporate accountability and corporate fines are a meaningful punishment for antitrust crimes. For instance, I participated in a panel discussion on this topic at the Bundeskartellamt’s Berlin Conference last year. During the discussion, a panelist provocatively suggested that competition enforcers are “drunk on fines” and suggested that corporate fines are not serving their intended deterrent purpose.

Jiji Press: “3 Ex-TEPCO Execs Indicted over March 2011 N-Disaster”

“Tokyo, Feb. 29 (Jiji Press)–Three former executives of Tokyo Electric Power Co. <9501> were forcibly indicted Monday by court-appointed lawyers serving as prosecutors over the unprecedented triple meltdown at its Fukushima No. 1 nuclear power plant.

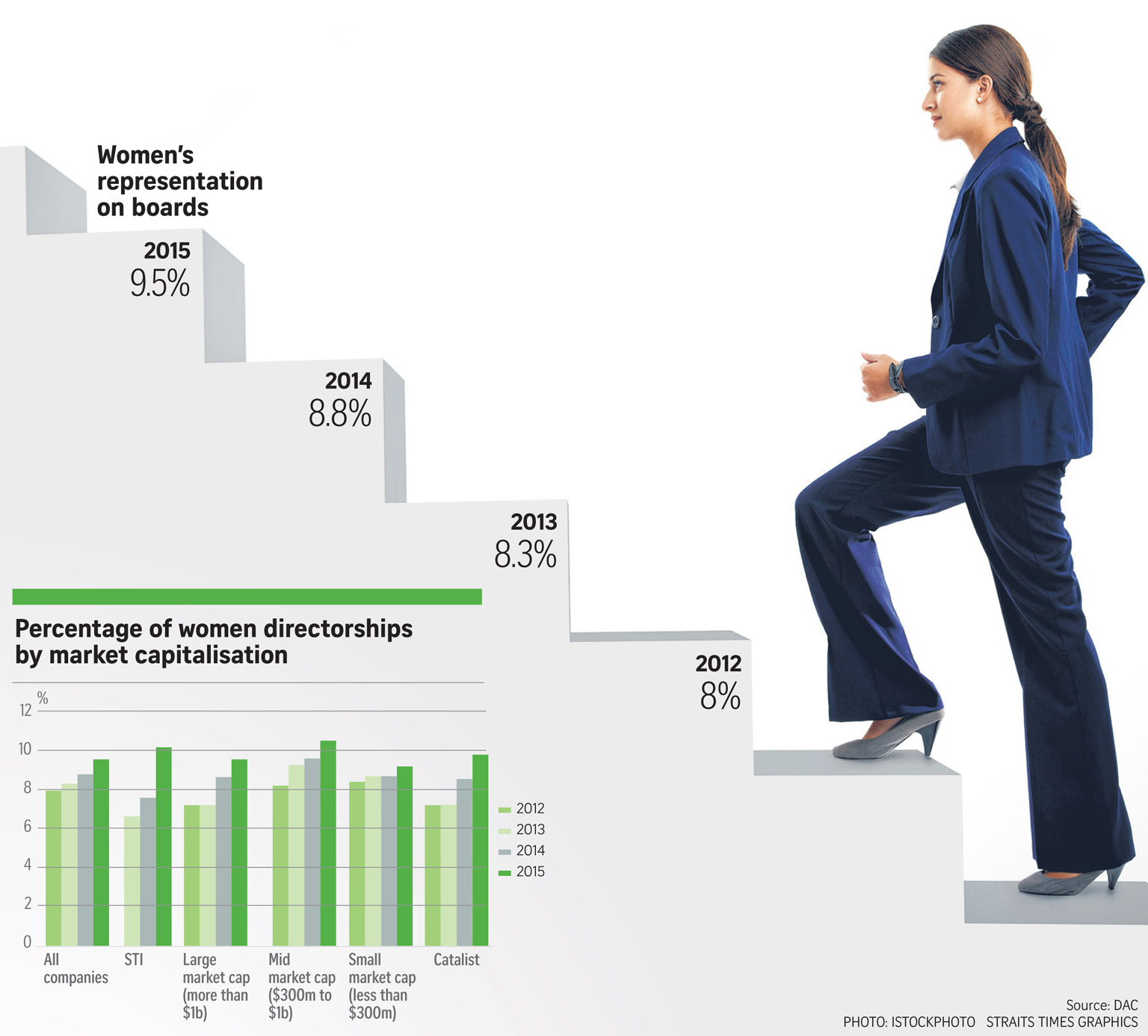

Diversity Action Committee: ”Women stepping up in Singapore boardrooms”

”Singapore’s top companies have led from the front in helping to remedy one of the blights on the local corporate scene – the under-representation of women on company boards.

A new report has found that across the 30 listed companies comprising the blue chip Straits Times Index (STI), 10.2 per cent of board seats were held by women last year, up from 7.6 per cent in 2014.

Report: ”Does CEO succession Planning Disclosure matter?”

IRRC INSTITUTE New Report by Annalisa Barrett, Founder and CEO of Board Governance Research LLC. Successful CEO transitions Correlate with More Robust Disclosure, but Succession Planning Disclosure Frequently is Non Existent and Often Inconsistent – A US perspective Executive Summary: ”Shareowners and other stakeholders have been calling for more information about CEO succession planning. This […]

Davos 2016 – Issue Briefing: Ethics and Corporate Governance (Video)

Learn first-hand about how corporate governance can ensure that high ethical standards are met to restore trust – Video

”Asia embraces corporate governance”

Japanese Prime Minister Shinzo Abe has vowed to put corporate governance at the heart of his economic reforms.

Nicholas Pratt interviews the OECD’s Fianna Jurdant and charts the development of corporate governance across Asia amid a growing recognition of its importance.

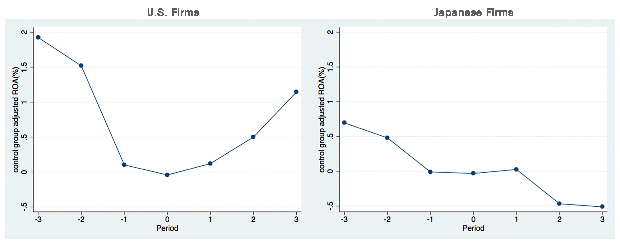

Prof. Kwon’s Research: Replace CEO in US, ROA Improves; Replace in Japan, It Does Not

”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power.

WEF: ”Could these 3 ideas reshape global governance?”

”Upwards and onwards … how can we make 21st century governance more more accountable, inclusive and efficient?”

BBC on the Bottom Line – Managing the Boardroom

A UK perspective – Managing the Boardroom (Audio) – ”After recent corporate scandals like VW’s emissions’ cheating, Tesco’s accounting irregularities, Barclays interest-rate rigging, many asked why company board members failed to act.

Forbes: ”To Regain Trust, Toshiba Needs More Than Stronger Governance”

A pedestrian walks past a Toshiba Corp. logo.

”Scandal-muddied Toshiba Corporation recently announced it was terminating its long-time relationship with Ernst & Young ShinNihon, its rubber-stamping auditor, and will hire PricewatherhouseCoopers Arata to replace it.