”Beginning in the 1990s, a silent revolution began to transform how business dealt with environmental, social, and governance (ESG) issues.

Author: Admin

How companies succeed through radical engagement | McKinsey & Company

“The authors of Connect: How Companies Succeed by Engaging Radically with Society explain why organizations must look beyond corporate-social-responsibility initiatives to truly engage with consumers and communities.

Antibusiness sentiment is nothing new. Yet mending the rift between big business and society isn’t merely a worthy goal—it may represent a new frontier of competitive advantage, profitability, and longevity for today’s organizations. In Connect: How companies succeed by engaging radically with society (PublicAffairs, March 2016), L1 Energy chairman and former BP chief executive officer John Browne, McKinsey’s Robin Nuttall, and entrepreneur Tommy Stadlen offer a practical blueprint for reconciling companies and communities.

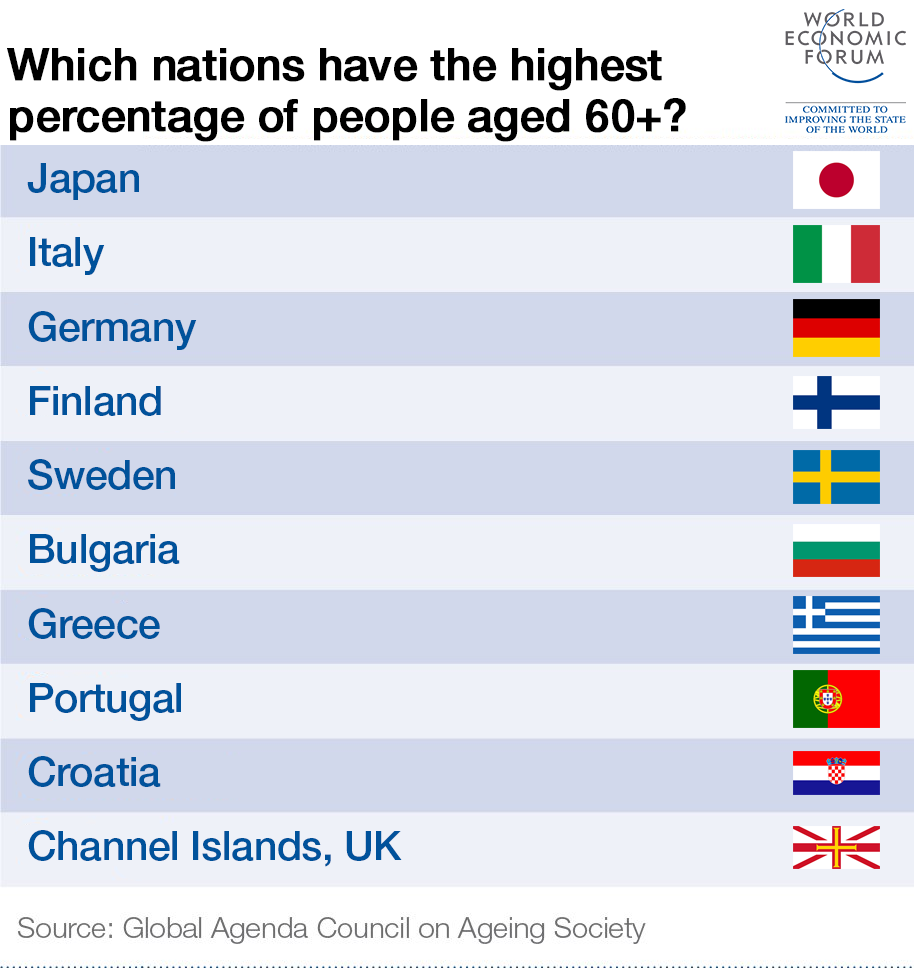

WEF: ”Japan’s population is shrinking: What does it mean for the economy?”

Now at 127 million, Japan’s population is forecast to fall to about 83 million by 2100

”Japan’s population has fallen by nearly 1 million in the past five years, in the first decline since the census began in 1920. This is bad news for the country’sshrinking economy, which is unable to depend on an expanding labour force to drive growth.

Forbes: ”To Regain Trust, Toshiba Needs More Than Stronger Governance”

A pedestrian walks past a Toshiba Corp. logo.

”Scandal-muddied Toshiba Corporation recently announced it was terminating its long-time relationship with Ernst & Young ShinNihon, its rubber-stamping auditor, and will hire PricewatherhouseCoopers Arata to replace it.

”Prosecutorial Bent Shows in SEC Accounting-Fraud Push, Ex-Official Says”

Mary Jo White, chair of the U.S. Securities and Exchange Commission, speaks at The Economic Club of New York, in Manhattan, June 20, 2014

”The Securities and Exchange Commission’s push to step up policing of accounting fraud could have a lasting impact on the agency’s work, bringing more cases related to poor internal controls and more actions against individuals, a top former official said.

”5 questions about Foxconn-Sharp takeover deal”

”Taiwan’s Foxconn has delayed the signing of a takeover agreement with Japanese electronics giant Sharp, leaving the US$5.9 billion acquisition up in the air. Will there still be a deal? We ask analysts”. ”SINGAPORE: The biggest takeover by a foreign company in Japan’s technology sector is looking less certain, after Taiwan’s Foxconn Technology Group said […]

”Bank of England chief accuses G20 of failing to reform to boost growth”

”Mark Carney rejects idea that central bankers have ‘used all ammunition’ against downturn but says system remains strong”

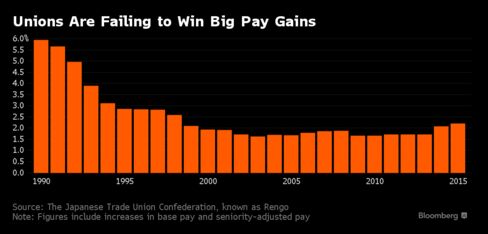

”Wage Talks Won’t Help Japan’s Abe”

”Shinzo Abe and Haruhiko Kuroda shouldn’t look to spring wage talks for much help in spurring inflation and economic growth in Japan.

If anything, the picture emerging from the negotiations between some of Japan’s biggest companies and their unions is one of stagnation and slim raises. And the talks, most of which conclude next month, are taking place as a strengthening yen risks pushing down the earnings growth — and stock prices — of Japanese exporters.

”Corporate Boards Seeking Sustainable Corporate Growth and Increased Corporate Value over the Mid- to Long-Term”

The Council of Experts Concerning the Follow-up of Japan’s Stewardship Code and Japan’s Corporate Governance Code has published “Publication of “Corporate Boards Seeking Sustainable Corporate Growth and Increased Corporate Value over the Mid – to Long – Term.

”Publication of the Policy Approaches to Strengthen Cyber Security in the Financial Sector”

The FSA published the Policy Approaches to Strengthen Cyber Security in the Financial Sector (Summary) in English. See Publication using link below.