”SAN FRANCISCO — The U.S. Department of Justice on Tuesday launched a pilot program that could significantly reduce the criminal penalties for companies that self-report violations of the Foreign Corrupt Practices Act.

Author: Admin

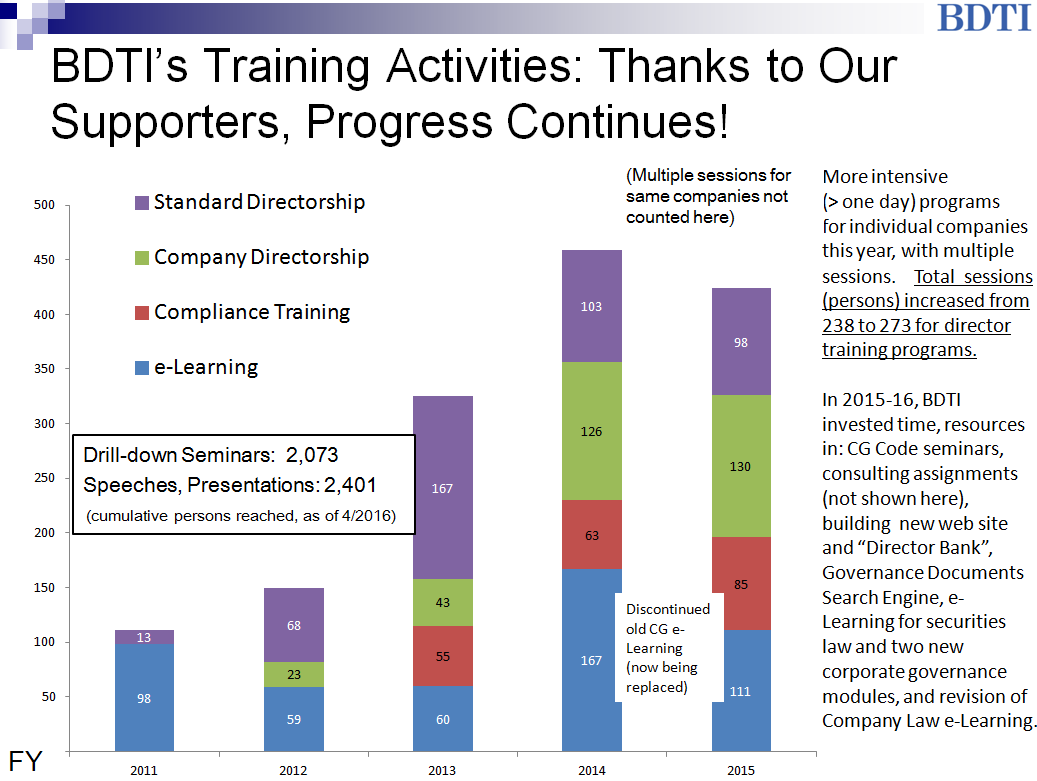

The Board Director Training Institute of Japan: Progress Report for FY2015

Below is BDTI’s recent report to its Sustaining Donors , who are listed here and described in Note 1 below. BDTI is now raising funds for FY2016, so if you are interested to support the cause of injecting deep understanding and substance into Japan’s recent governance reforms, please consider making a donation.

- We aggressively followed up on my proposal to create a Corporate Governance Code for Japan, which became a reality in June thanks to the fine efforts of many others (See Note 2) over many years. We gave a number of seminars (and still are) on the most important aspects of the CG Code, how to approach compliance with it, and the need for companies to produce their own “CG Guidelines” in order to actually have the policies (and substance) they claim they have in TSE governance reports. This was a concept that BDTI (myself) had proposed and promoted from the very start, a year before the CG Code came into effect.

asssa

Our activities last year included producing example CG Guidelines, numerous BDTI seminars or speaking engagements, and a large joint seminar with Mizuho Research (we will have another soon.) These efforts were successful in encouraging approximately 30% of Japanese companies to produce corporate governance guidelines, even thought the quality of many of these still needs to be improved. See the results of this survey.

Bloomberg: ”Loeb Prevails in Latest Crusade to Reform Corporate Japan”

”The idea of an octogenarian CEO in questionable health ousting a potential successor to make way for his own son would be met by hackles, maybe even outright laughter, by many corporate governance experts and shareholder activists in the U.S. and Europe. Yet that’s what Dan Loeb accused Seven & i Holdings Co. Chief Executive Officer […]

ACGA’s Feedback to FSA on Japan’s Governance Code: Training by Specialist Providers Important

”………Experience shows that the implementation and evolution of “comply and explain” can take a long time to develop, but there are opportunities to accelerate this transition. The Follow-up Council may wish to consider how to guide and assist Japanese listed companies and domestic institutional investors to understand and implement good disclosure. For example, the Council could advise the FSA to do the following:

Bloomberg : ”Japan Inc. Fights Back on Governance Overhaul as Waste of Time”

”Many Japanese companies aren’t happy about the biggest overhaul of corporate governance in decades — and they’ve been letting the world’s biggest pension fund know.

GPIF: ”Summary Report of Listed Companies’ Survey about Institutional Investors’ Stewardship Activities”

Ⅰ. Purpose of the Survey

The Government Pension Investment Fund, Japan (GPIF) conducted our first survey to JPX Nikkei Index 400 companies to evaluate stewardship activities of our external asset managers and to grasp real situation of constructive dialogues. As we stated in “Summary Report of GPIF’s Stewardship Activities in 2015” dated of 29th January 2016, it is our intention to raise the standard of dialogues between institutional investors and Japanese companies.

Daniel E. Wolf et al :”Social Covenants in Mergers: Legal Promises or Moral Commitments?”

‘With the return of acquirer stock as a featured form of consideration in many recent deals, dealmakers are once again focusing on “social” issues in striking a merger agreement. As compared to most straight cash takeovers where price garners the overwhelming share of, if not exclusive, attention, an acquisition featuring stock consideration, and especially a so-called merger-of-equals, often involves significant discussion between the parties of softer issues, including governance, board composition, management, people, and corporate identity (e.g., corporate and brand names, headquarters and facility locations, and charitable and community commitments). A number of deal developments over the last few years highlight some of the risks and considerations unique to these social terms.

Terry Lloyd: ”Sharp: How Not to Sell a Company in Japan”.

E-biz news in Japan

”Late last week, Mr. Terry Gou, the CEO of Foxconn Technology Group (also known as Honhai) signed a JPY389bn deal to take control of Sharp, one of Japan’s bedrock electronics firms. The signing came after a protracted cat-and-mouse game played between Mr. Gou, the management of Sharp, and in the wings, the public-private INCJ fund. Mr. Gou showed consummate deal sense in luring Sharp’s board with a much more attractive offer than the government’s INCJ (which wanted to break up the firm) then drag out the negotiations as Sharp was facing a possible collapse. Lastly, with impeccable timing he sprang a last minute demand to reduce the deal price by 20% and completely out-maneuvered, Sharp’s executives and shareholders, who eventually caved in and agreed.

Bloomberg: ”Loeb Takes on Seven & I Board in Test Case for Japan Governance”

”The latest activist showdown involving billionaire investor Dan Loeb has the makings of a test case for the progress Japan Inc. boards have made in improving governance.

”Foxconn agrees to buy Japan’s Sharp Corp. for $3.5 billion”

Acquisition comes after weeks of uncertainty over deal at higher price

”TAIPEI, taiwan — The Taiwanese company that assembles Apple’s iPhones agreed Wednesday to buy control of financially struggling Sharp Corp. for $3.5 billion in the first foreign takeover of a major Japanese electronics producer.