Metrical provides monthly corporate governance assessments of approximately 1,800 companies, primarily prime market listed companies. This year, continuing on from last year, we would like to see how much progress has been made in corporate governance initiatives by listed companies over the past year.

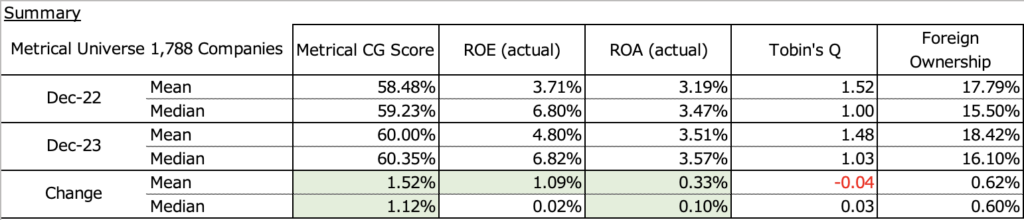

We analyzed how much the 1,788 companies in the comparable Metrical universe improved in each evaluation category between December 31, 2022 and December 31, 2023. The table below shows the Metrical CG score, which is the overall corporate governance score, the average ROE and ROE over the past three years, the change in Tobin’s Q and foreign shareholding ratio in December 2022, December 2023, and change from 2022 to 2023, and the mean and median values.

The Metrical CG score, the overall corporate governance score, improved by 1.52 pts on average and 1.12 pts on median over the year. The score is gradually improving each year. In the value creation index, the mean for both ROE and ROA increased, but the median increased only slightly, indicating that profitability and capital efficiency efforts are still a challenge for many companies. Tobin’s Q has changed little over the year. Although the TSE’s request for a P/B increase came at the end of March, it can be seen that no significant changes in share price valuations occurred for listed companies as a whole in the nine months that followed. This is evident in the foreign shareholding ratio. Both the mean and median foreign shareholding ratios remain at 0.60 pct. Although the Japanese stock market rallied significantly from April to June 2023 due to strong buying by overseas investors, the increase in the ratio of foreign holdings was not reflected in the increase in the market. Although overseas investors are interested in Japanese stocks, their weighting in the Japanese stock market has not increased significantly. This may be the reason why stock valuations did not increase significantly.

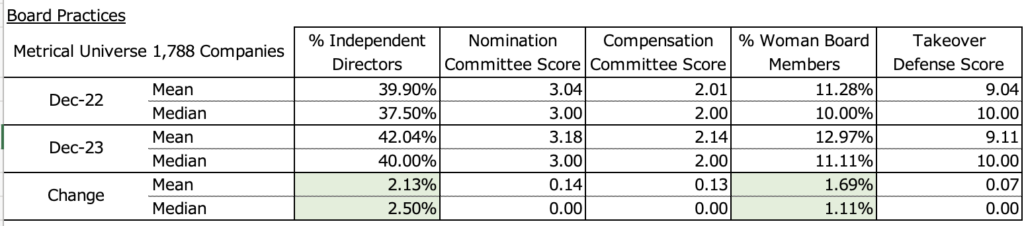

Below is a more detailed look at each of the corporate governance assessment items. The table below shows the change from December 2022, December 2023, and from 2022 to 2023 for the Board Practices assessment items, as well as the mean and median values for each. the improvement in the Board Practices initiative is in the ratio of independent directors. The degree of improvement is smaller than in 2022, when the 2021 Corporate Governance Revision required prime market listed companies to have a ratio of at least 1/3 of independent directors, but it has increased by more than 2 ppt in the last one year. Even the median independent director ratio is now in the 40% range, raising expectations of a majority; the ratio of female board members, which was the focus of attention in 2023, has increased by a little over 1%, but is still in the low 10% range. The target for the ratio of female board members for prime market listed companies as requested by the government and TSE is 30% by 2030, so there has been no significant increase or movement, perhaps because many companies are using all the time they have to achieve this target. There has been little improvement over the past year in the efforts of the Nominating and Compensation Committees to comply with the revised 2021 Corporate Governance Code. There has also been little change in Takeover Defense scores as many of the companies that once had advance warning takeover cormorant defenses in place have eliminated them. In terms of organizational structure, only 6 of the 1,788 companies in the Metrical universe transitioned to a Company with US type 3 Committees, and 58 transitioned from a Company with Board Statutory Auditors to a Company with Audit Committee. The number of companies actively seeking to transition to a Company with Board Statutory Committees remains limited.

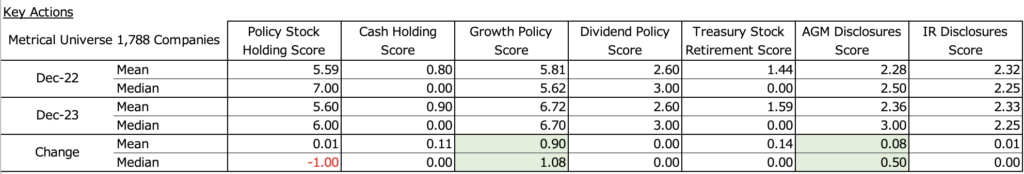

The table below shows the change values from December 2022, December 2023, and from 2022 to 2023 for the Key Actions assessment items, as well as the mean and median values for each. The Growth Policy score and AGM Disclosures score improved for Key Actions initiatives. In addition to an increasing number of companies including ROIC in their KPIs, the improvement in the Growth Policy score can be attributed to the fact that it has become easier to set numerical targets against the backdrop of the performance recovery from the COVID-19 pandemic. The AGM Disclosures score improved as a result of the majority of prime market listed companies participating in the voting platform and the early mailing of AGM convocation notices becoming more prevalent. On the other hand, there was no notable improvement in the Policy Stock Holding score, Cash Holding score, Dividend Policy score, and Treasury Stock Retirement score. This, together with the lack of significant improvement in the IR Disclosures score, indicates that the company needs to rationally demonstrate how it uses cash to increase corporate value. The lack of investor buy-in in this regard has not led to higher share price valuations.

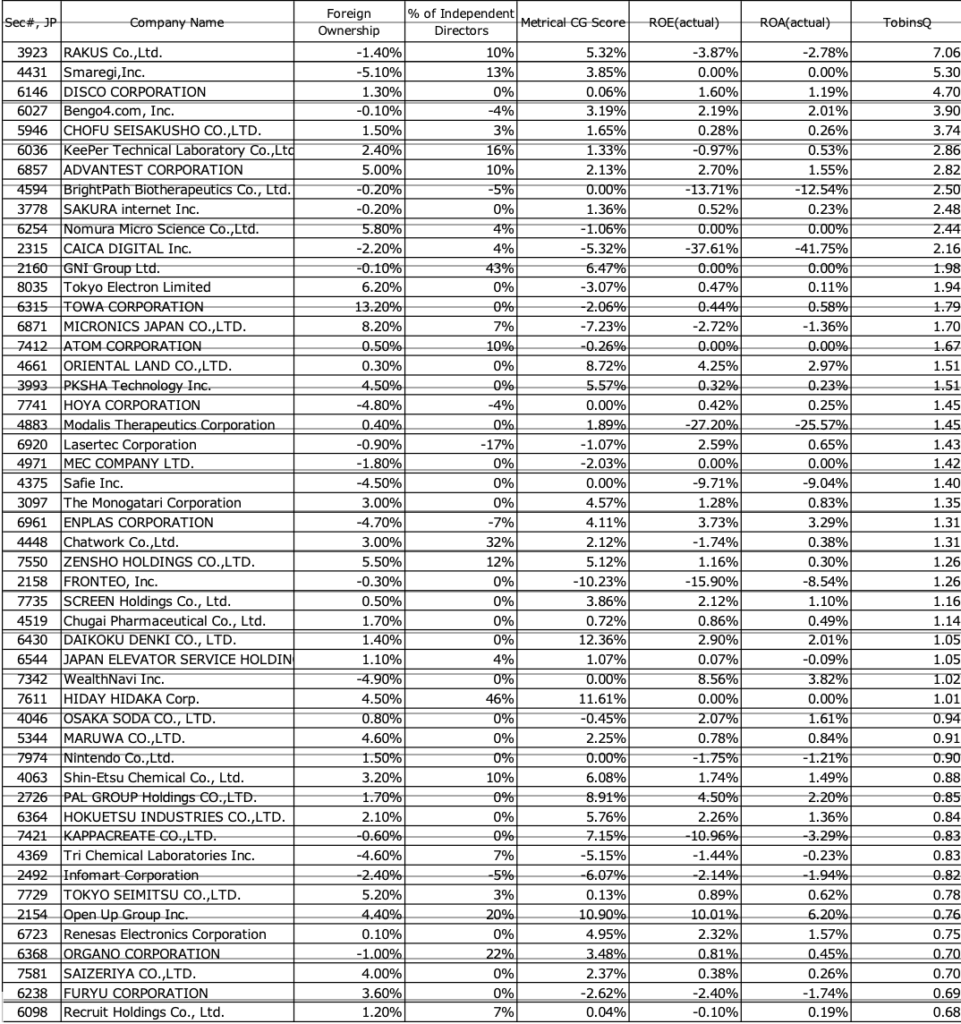

The table below shows the main companies that increased Tobin’s Q in 2023.

In summary, I have considered how much progress has been made in corporate governance initiatives by listed companies during the year 2023.

The Metrical CG score, the overall corporate governance score, improved by 1.52pts on average and 1.12pts on median over the year, with scores improving slightly each year. Median scores for both ROE and ROA increased only slightly, indicating that profitability and capital efficiency efforts are still a challenge for many companies. Despite the TSE’s request to raise the P/B at the end of March, Tobin’s Q has changed little over the year. This is evident in the foreign shareholding ratio.

With regard to the evaluation of Board Practices, the ratio of independent directors improved less than it did in 2022, but the gradual upward trend continues. The ratio of female board members increased by a little more than 1%, but is still in the low 10% range, which is still far from the “30% by 2030” ratio of female board members for prime market listed companies required by the government and TSE. There was little change in the Nominating and Compensation Committees and the elimination of the advance warning takeover cormorant defense. Of the 1,788 companies in the Metrical universe, only 6 have moved to Company with US type 3 Committees and 58 have moved from Company with Board Statutory Auditors to Company with Audit Committee. It can be said that few companies actively want to transition to a company with statutory committees.

As for Key Actions, the Growth Policy score improved as more companies included ROIC in their KPIs, and the AGM Disclosures score improved as the majority of prime market listed companies joined the voting platform. On the other hand, there were no notable improvements in the Policy Stock Holding score, Cash Holding score, Dividend Policy score, and Treasury Stock Retirement score related to the use of cash. Considering that the IR Disclosures score also showed no notable improvement, it can be said that the company has failed to take action on how to use cash to increase corporate value. A policy that is convincing to investors in this regard would lead to an increase in stock valuations.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/