Metrical provides monthly corporate governance assessments of approximately 1,700 companies with market capitalization exceeding approximately 10 billion yen, primarily those listed on the TSE 1st Section. This year, continuing on from last year, I would like to see how far listed companies have progressed in their corporate governance efforts over the past year.

The chart below shows the changes in each of the evaluation items for approximately 1,700 companies in the Metrical Universe over the past 3 years (December 2020, December 2021, and December 2022). Metrical divides the evaluation items into Board Practices and Key Actions. This time, I will look at the Board Practices section. Let’s take a look at them in order.

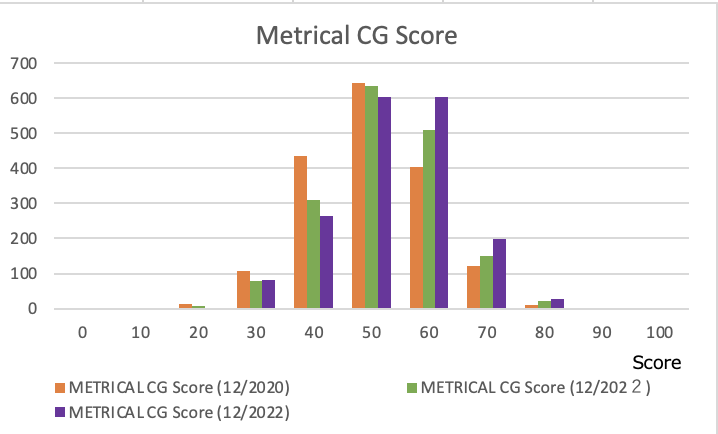

The first chart shows the distribution of Metrical CG scores, which represent the overall corporate governance rating of a listed company across a number of corporate governance measures. The distribution of scores in December 2022 is indicated by purple bars. distribution of the bars shows that the distribution of the bars moves to the right (toward higher scores) with each subsequent year, from December 2020, December 2021, and December 2022. It can be inferred that listed companies have advanced their corporate governance initiatives in response to the revision of the Corporate Governance Code in 2021 and the market reorganization of the TSE in 2022. Let’s take a look at the contents of these efforts by evaluation item below.

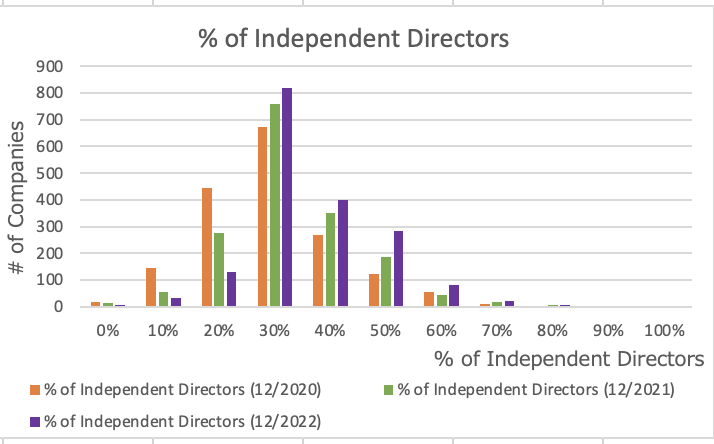

The next chart shows the ratio of independent directors. The ratio of independent directors to total directors is a key indicator of board practice, and previous analysis has shown that it is also closely related to performance indicators of listed companies. The Corporate Governance Code revised in 2021 requires companies listed on the prime market to have an independent director ratio of at least 1/3 of the total number of directors.

The Corporate Governance Code revised in 2021 requires companies listed on the prime market to have an independent director ratio of at least 1/3 of the total number of directors. As a result, the distribution of green bars in December 2021 shifted to the right (higher score) compared to the orange bars in December 2020.The distribution of purple bars indicating the ratio of independent directors in December 2022, when the prime market was launched as a result of TSE’s market restructuring, also continued to shift to the right. While most companies currently meet the minimum requirement of at least 1/3 of the independent director ratio, which is considered the listing standard for the prime market, the number of companies with an independent director ratio of 50% or more is also on a gradual increase. Although I will not go into the details here, I cannot rely on these figures, as there are issues of whether independent directors are not friends of the president and whether they are required to fully function on the board of directors in a truly independent capacity. However, the trend is that the ratio of independent directors is rising.

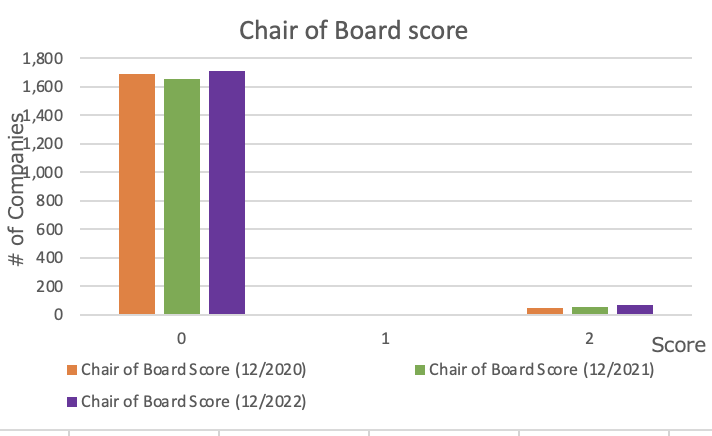

The chart below shows the score for who chairs the board of directors. I score companies with a score of 2 if the independent director chairs the board of directors. Most companies have an internal executive director chairing the board; the distribution has changed little compared to December 2020 and December 2021. If the above independent director ratio is over 50% and the independent director is not a friend of the CEO and the independent director is required to function on the board in a truly independent capacity, then board independence would be ensured even if the board is chaired by the CEO or other internal executive director. However, since the ratio of independent directors in many companies is somehow above 1/3 and the board of directors is chaired by an internal executive director such as the CEO, there is a great concern as to whether the opinions of independent directors are reflected in the agenda.

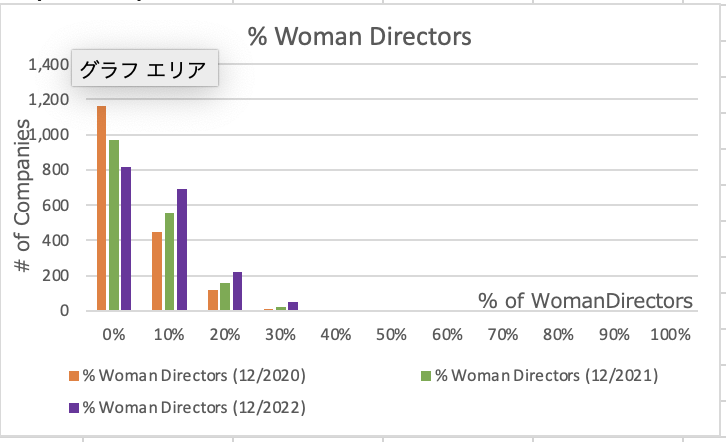

The next chart shows the percentage of female directors. Compared to December 2020 and December 2021, the ratio of female directors in December 2022 has been improving slightly. This is due to the fact that an increasing number of investors, especially overseas institutional investors, have indicated that they will vote against the election of board directors at the general shareholders’ meeting of companies that do not have female directors. Very few companies have more than 30% female directors. Although there was a reference to the importance of diversity in the revised Corporate Governance Code, no specific numerical targets have been set. Unless specific targets, such as a ratio of 30% or more of female directors, are clearly stated in the Corporate Governance Code, rapid improvement cannot be expected. Failure to ensure diversity on the board of directors means that management does not consider the value of diversity to be important to the company’s management. This evaluation item is very important not only because it indicates the seriousness of management’s corporate governance efforts, but also because it indicates whether the management strategy perspective includes a diversity element.

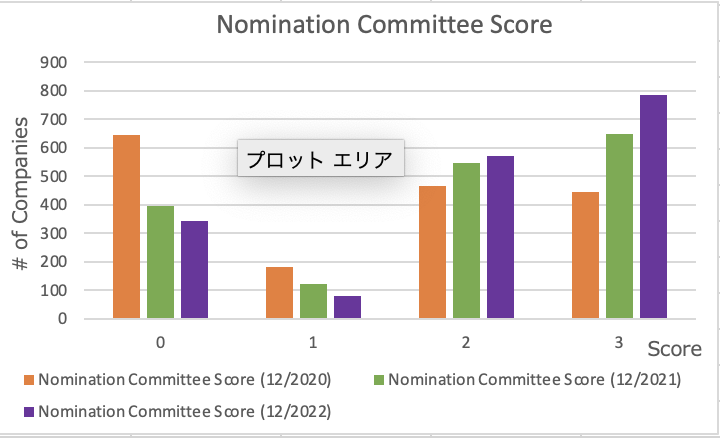

The next chart shows the Nominating Committee Score. It assesses whether the company has a nominating committee, whether a majority of the members of the committee are independent directors, and whether the committee is chaired by an independent director. The revised Corporate Governance Code requires companies listed on the prime market to have a nominating committee, even if it is a voluntary committee, and that a majority of the members of this committee be independent directors. Compared to December 2020 and December 2021, the distribution of purple bars in December 2022 has shifted to the right (higher score). Score 2 indicates cases where, in many cases, a voluntary nominating committee is established and a majority of the members of that committee are independent directors, but the committee is chaired by an internal executive director. As noted above, there is also the question of whether the independent directors are truly independent and not friends of the CEO, and whether the nominating committee is truly required to function.

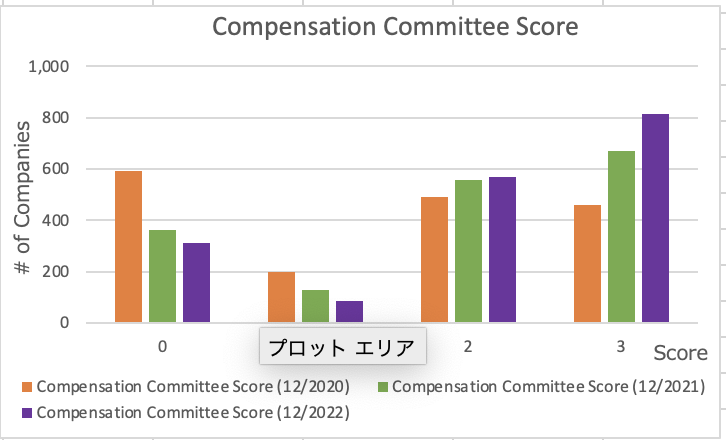

The next chart shows the Compensation Committee Score. Similar to the Nominating Committee above, the Compensation Committee is also evaluated based on whether it is established, whether a majority of the members of the committee are independent directors, and whether the committee is chaired by an independent director. The revised Corporate Governance Code requires companies listed on the prime market to have a compensation committee, even if it is a voluntary committee, and that a majority of the members of this committee be independent directors. The same score was expected to increase in 2021; compared to December 2020 and December 2021, the distribution of purple bars in December 2022 has shifted to the right (higher score). Score 2 indicates cases where, in many cases, a voluntary compensation committee is established and a majority of the members of that committee are independent directors, but the committee is chaired by an internal executive director. As noted above, there is also the question of whether the independent directors are truly independent and not friends of the CEO, and whether the compensation committee is truly required to function.

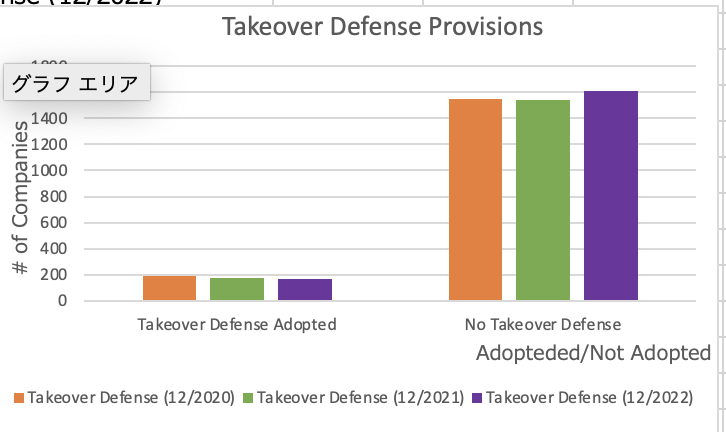

The next chart shows takeover defenses. Many listed companies have already disclosed that they will not adopt advance warning takeover defenses, and there has been no significant change over the past 3 years. Metrical’s analysis shows that companies that have adopted advance warning takeover defenses tend to discontinue these provisions when the foreign ownership ratio exceeds 30%. It would be difficult for a company with a high ratio of foreign shareholders to adopt an advance warning takeover defense again. Meanwhile, it is possible that these companies may exercise some takeover defense against a takeover if a takeover situation arises.

In summary, it can be said that corporate governance efforts in 2022 have generally improved in board practices over the past three years, as seen in the revised Corporate Governance Code of 2021 and the listing criteria for the prime market, which was included in the TSE’s market restructuring that started in 2022. While the ratio of independent directors and the Nominating and Compensation Committee have improved significantly, the Chairman of the Board of Directors, which was not specified in the Corporate Governance Code, has not improved. In addition, the ratio of female directors, for which the Corporate Governance Code did not provide specific target figures, improved at a very slow pace. More to the point, with regard to whether independence is truly ensured by the ratio of independent directors and the Nominating and Compensation Committee, which have been improving, there are concerns about whether the Board of Directors and the Nominating and Compensation Committee require independent directors to truly function independently, since independent directors are often friends of the CEO. In this light, the ratio of female directors can be seen as an indication of the seriousness of the company’s efforts to improve from a decision-making body that proceeds with a homogeneous internal executive director-centered logic to a board of directors that makes management decisions from a diversity of opinions.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/