“ Despite the increased attention and capital incentives around corporate sustainability, the development of sustainability reporting standards and monitoring systems has been progressing at a slow pace. As a result, companies have misaligned incentives to deliberately or selectively communicate information not matched with actual environmental impacts or make largely unsubstantiated promises around future ambitions. These incidents are broadly called “greenwashing,” but there is no clear consensus on its definition and taxonomy. We pay particular attention to the threat of greenwashing concerning carbon emission reductions by coining a new term, “carbonwashing.” Since carbon mitigation is the universal goal, the corporate carbon performance data supply chain is relatively more advanced than that of the entire sustainability data landscape. Nonetheless, the threat of carbonwashing persists, even far more severe than general greenwashing due to the financial values attached to corporate carbon performance. This paper contextualizes sustainable finance-related carbonwashing via an outline of the communication as well as the measurement, reporting, and verification (MRV) of carbon emission mitigation performance. Moreover, it proposes several actionable policy recommendations on how industry stakeholders and government regulators can reduce carbonwashing risks.”

Month: July 2021

7/13 “Director Boot Camp” Held by Zoom! Next Courses: 2021.09.07 & 11.18!

We are planning to hold the next course on September 7th(Tue) & November 18th (Thur) 2021. Sign up early! Please see a description of our director training course here or click the button below for further information.

METRICAL:S (Social) in ESG

Recently, awareness of ESG (or SDGDs) is spreading among the society and stakeholders surrounding companies. There are more and more opportunities for companies to introduce their ESG initiatives in analyst meetings, CSR reports, and integrated reports. It is a good thing to deepen the understanding among society and all parties concerned. More and more listed companies are giving presentations on their ESG initiatives at analyst meetings to explain their financial results, following their financial reports and outlooks. In this context, I have some questions. One of them is that not a few companies are focusing on BCP (Business Continuity Plan) as their G (Governance) initiative. Secondly, as part of their S (Social) initiatives, they are focusing on social contribution activities. This time, I would like to discuss the latter S.

It seems that there are many listed companies that feel that S (Social) is somewhat obscure when they come into contact with the ESG reports of companies on a daily basis. As mentioned above, we often see cases where companies introduce their social contribution activities or efforts to improve the working environment (e.g., work-life balance, childcare and family leave programs) as examples of their S initiatives. Of course, such individual efforts are included in the S (Social) category, but I feel that for the sustainable growth of companies, we should pay more attention to the improvement of the social environment from a broader perspective. Companies are engaged in corporate activities in a society where people are related to each other in various positions. In order to promote the smooth operation and sustainable growth of corporate activities in such a society, I think it would be a good idea to communicate that the company is managing its business from the standpoint of respecting human rights from a broad perspective.

Some companies that have taken the lead in ESG initiatives are now expressing their basic stance on human rights. I think it is easier for many people to understand if they follow this basic approach to human rights and refer to individual initiatives. Many of the companies that take this approach are large companies with global operations. This is probably because they understand that understanding and respecting diversity and people’s rights is essential for conducting business, and that this will reduce business risks. However, many Japanese companies don’t take this approach and express their views on “human rights”, but only describe individual initiatives such as those mentioned above in their reports.

METRICAL:CG Stock Performance June 2021

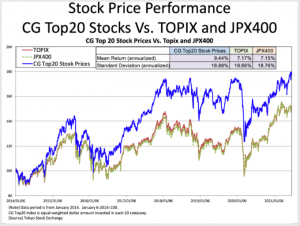

As in the previous month, June stock market continued directionless trading and closed slightly higher in thin trading. The CG Top 20 significantly outperformed both the Topix and JPX400 indices.

Despite a temporary decline in the second half of the month, the stock prices continued to lack a sense of direction due to low trading volume and lack of material to take hold of throughout the month.

The Topix and JPX400 indices rose 1.17% and 0.82%, respectively, during the month of June, while the top 20 CG rating score stocks outperformed for the third consecutive month at 3.50%.

The CGTop 20 stocks composites will be reviewed at the end of June each year, and their performance will be measured using the new components from July 1.

BDTI Welcomes Eiji Hirano, Former Chair of the GPIF’s Board of Governors, as a New Director to its Board

The Board Director Training Institute of Japan (BDTI) is pleased to welcome Eiji Hirano to its board of directors, effective as of July 1st, 2021.

Until April of this year, Mr. Hirano served as the first Chairperson of the Board of Governors of the Government Pension Investment Fund of Japan (GPIF), which is the world’s largest national pension fund with approximately USD1.62 Trln (178 Trln Yen) under management. During his time as Chair, Mr. Hirano stressed the importance of corporate governance as one of the essential pillars of ESG at both portfolio companies and the GPIF itself. He led the GPIF’s board in overseeing management of its massive portfolio during a time of accelerating change, a global pandemic, and growing world-wide recognition of the need for greater corporate sustainability.

Mr. Hirano’s career has spanned economics, international financial markets, investment, public policy and corporate governance, and he has a Master’s degree in Economics from Harvard University. In addition to his recent experience at the GPIF, Mr. Hirano brings to BDTI a wealth of perspectives gained from his distinguished career at the Bank of Japan, where he stepped down as an Assistant Governor at 2006, and other positions in the private sector. Currently, he serves as the non-executive Vice-Chair of MetLife Japan, and as an outside director at NTT Data and Riken. He is also an auditor at the Keizai Doyukai and a member of Japan UNESCO‘s domestic committee.

Commenting on Mr. Hirano’ appointment, BDTI Representative Director Nicholas Benes said, “we are honored and excited that Mr. Hirano has joined our mission to improve the effectiveness of boards by providing practical, high-standard directorship training programs.” Echoing his sentiment, fellow Representative Director Kenichi Osugi (Professor of Law at Chuo University) said, “Mr. Hirano’s broad range of experience will help us better prepare board members for what faces them in the future.”

Mr. Hirano said, “the success of sustainable investment depends largely on the quality of boards and corporate governance, and the best way to meaningfully improve those things is through new knowledge, sharing of “best practices”, and discussion, — all the things the director training entails. Therefore, director and governance training are essential for society. We need to tirelessly convey this reality to those asset managers that are adopting ESG and impact investing techniques, but may be uncertain as to how they can make a more direct contribution to overall sustainability. I am hoping to encourage more domestic institutions to support BDTI’s activities.”