” Executive Summary

More than a quarter of assets under management (AUM) worldwide are invested in “sustainable” strategies, strategies that consider environmental, social, and governance (ESG) factors in pursuit of financial sustainability and/or environmental or social sustainability. Investors – both individual and institutional and at all wealth levels – are increasingly interested in integrating these strategies into their financial plans and investment portfolios, and asset managers and global financial institutions are embracing the approach and expanding related services and product offerings.

Interest in sustainable investing and sustainably invested AUM are growing rapidly in Japan. But despite this enthusiasm and growth, few mainstream investors, financial advisors, and investment consultants in Japan are embracing the practice.

We – The Investment Integration Project (TIIP) – partnered with The Sasakawa Peace Foundation(SPF) to examine why some investors and others in Japan’s financial community do not incorporate sustainable investing into their practices, and to recommend breakthroughs needed to grow the practice in Japan. We also preliminarily identified barriers and opportunities for sustainable investing elsewhere in Asia (Singapore, Hong Kong, and China). To fulfill these objectives, we reviewed relevant literature on sustainable investing in Japan and consulted with more than 50 experts on Japan’s financial industry.

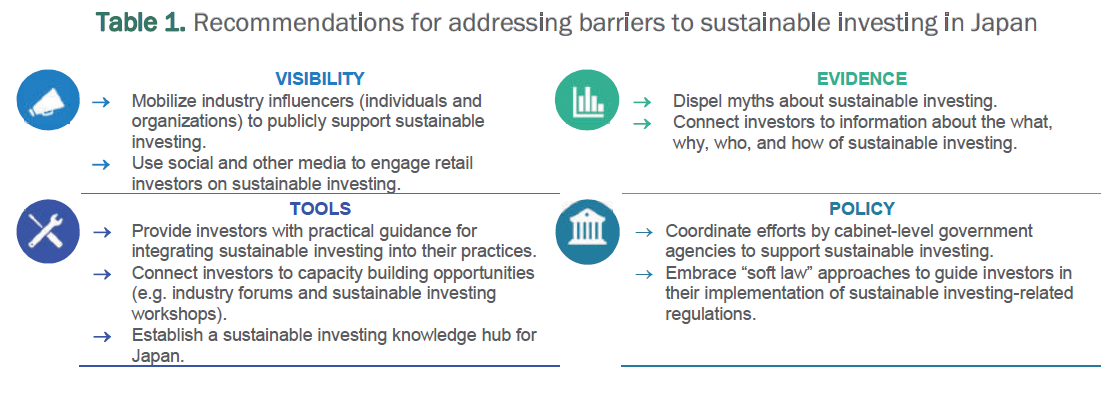

We identified the following as the primary barriers to the widespread adoption of sustainable investing in Japan:

- Visibility: the Japanese financial community remains generally unaware of sustainable investing;

- Evidence: myths about sustainable investing are pervasive in Japan;

- Tools: there is a shortage of practical resources for the Japanese financial community that instruct on how to integrate sustainable investing into investment practices; and

- Policy: government and regulatory agency efforts to support sustainable investing are fragmented.

There are a series of practical steps that Japan’s financial community can take to start to address each of these challenges, which we list in Table 1 below and detail in the “Recommendations for Action” section of this Agenda. In taking these steps, Japan, with the third-largest economy in the

world, can begin to capitalize on increasing momentum for sustainable investing and, in doing so, help investors to promote social, environmental, and financial sustainability.”