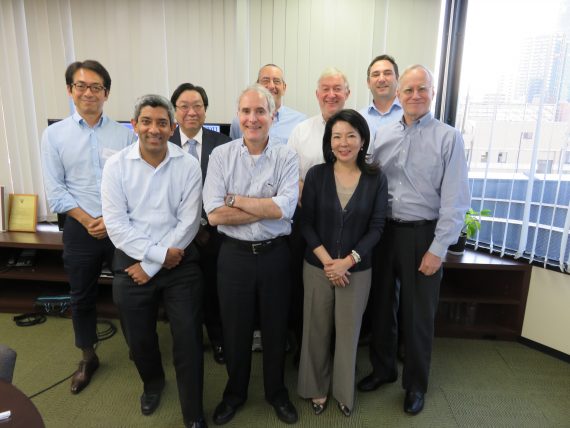

On May 12th, BDTI held its English Director Boot Camp , attended by a number of highly experienced participants. Participants from various companies heard lectures about corporate governance by Nicholas Benes and Andrew Silberman of AMT, and exchanged experiences and opinions at a spacious, comfortable room kindly donated for our use by Cosmo Public Relations, a leading communications and PR firm in Tokyo.

We are planning to hold the next course on July 14th. Sign up early!