Background:

Last year, Japan introduced codes designed to work together to increase corporate value and investor return in Japanese companies. The Corporate Governance Code and the Stewardship Code are supposed to work hand-in-hand to promote transparency and sustainable growth. Part of the Corporate Governance Code calls for companies to have at least two independent directors. Having outsiders on board, it was hoped would bring discipline as companies reach for higher profits.

Hoang C. C. et al : ”Institutional Investors and Trends in Board Refreshment”

”As many institutional investors have concluded, prevailing governance policies and practices have not produced desired board refreshment, which these investors would support in order to strengthen expertise, promote diversity and provide fresh perspectives in the board room. At the same time, companies and investors alike appreciate that term and age limits, as they have been typically applied, may not be the solutions, because they force the arbitrary retirement of valuable directors.

Lexology: ”U.S. Bill Would Prioritize Cybersecurity at the Board Level”

”In recent years, there has been an increase in the frequency and sophistication of cybersecurity attacks on both businesses and governments. There has also been an increased interest in government regulation of cybersecurity to protect the public from data breaches. Recently, two American Senators – one Democrat and one Republican – introduced a bill that would require publicly traded companies to have a cybersecurity expert on their board, or explain why having such a board member is unnecessary.

Kato Takao and Kodama Naomi: ”Corporate Social Responsibility and Gender Diversity in the Workplace: Evidence from Japan”

”Abstract: Using panel data on corporate social responsibility (CSR) matched with corporate proxy statement data for a large and representative sample of 1,492 publicly-traded firms in Japan over 2006-2014, we provide rigorous econometric evidence on the effects of CSR on gender diversity in the workplace. Our fixed effect estimates point to positive and significant effects on gender diversity of CSR, yet the effects are felt only after two to three years.

FSA: ”Advisory Council recommendations on strengthening the audit framework”

”The Advisory Council on the Systems of Accounting and Auditing, set up by the Financial Services Agency to make recommendations to improve the external audit framework in Japan, published its report and recommendations earlier this year. An English translation of the report and recommendations was published last week.

Bloomberg: ”Asia set to turn tables on lagging ESG transparency”

Asian exchanges push for greater ESG disclosure to woo investors

”Asian stock exchanges are seeking to improve the region’s historically weak record of environmental, social and governance (ESG) disclosures.

KKR & Co. LP: ”Strengthened Corporate Governance Will Help Drive Japan’s Economy”

”Japan, the question of value creation has become increasingly important as corporate governance evolves and Japanese industry restructures in the era of Abenomics, Prime Minister Shinzo Abe’s plan to jolt the world’s third-largest economy.

VIDEO – ”Assessing Abe’s Third Arrow: Corporate Governance Reform in Japan”

”As doubts persist about the progress of Prime Minister Shinzo Abe’s “third arrow” structural reforms to lift the Japanese economy, corporate governance is one area where change has been visible over the past three years: a new Stewardship Code for institutional investors, a Corporate Governance Code for companies themselves, a new JPX-Nikkei 400 index with minimum ROE and independent director requirements for inclusion, and efforts to increase the number of women on corporate boards and in senior management. How will these changes affect the performance of Japanese companies? What are the implications for the Japanese economy and for the success of Abenomics? What more could be done? As part of our continuing examination of major trends in the world’s third-largest economy, the CSIS Simon Chair will host experts from government, business, and academia to discuss Japan’s recent corporate governance reforms………..”

The Recorder: ”DOJ Sweetens Rewards for FCPA Cooperation”

”SAN FRANCISCO — The U.S. Department of Justice on Tuesday launched a pilot program that could significantly reduce the criminal penalties for companies that self-report violations of the Foreign Corrupt Practices Act.

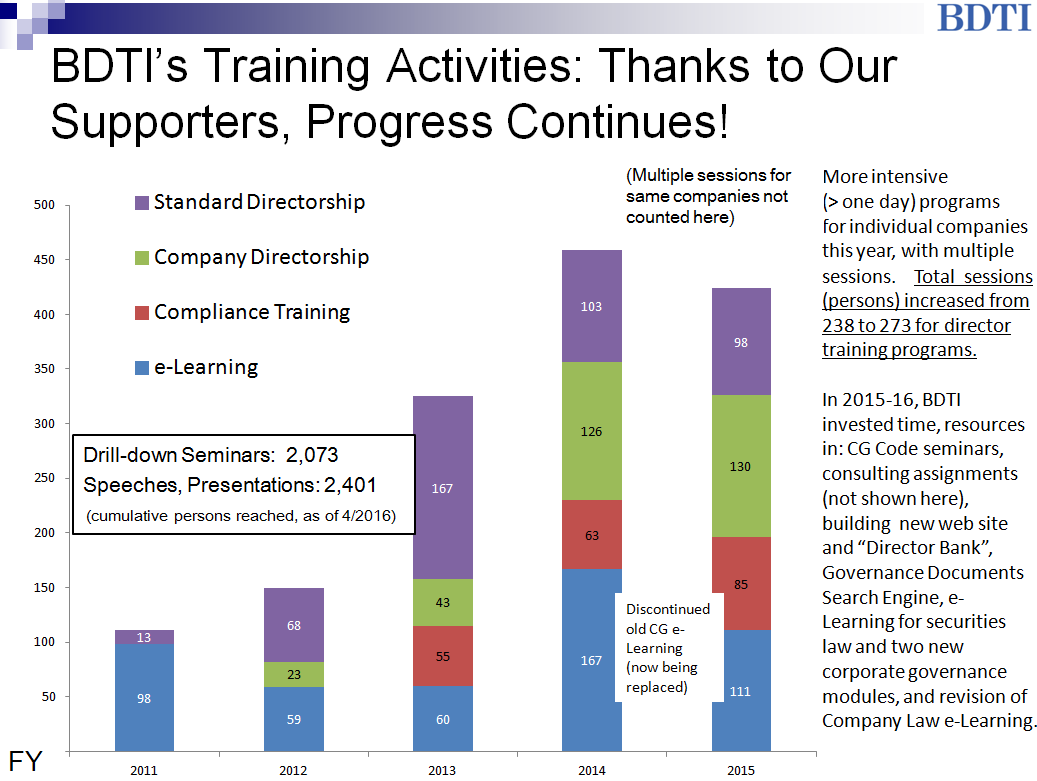

The Board Director Training Institute of Japan: Progress Report for FY2015

Below is BDTI’s recent report to its Sustaining Donors , who are listed here and described in Note 1 below. BDTI is now raising funds for FY2016, so if you are interested to support the cause of injecting deep understanding and substance into Japan’s recent governance reforms, please consider making a donation.

- We aggressively followed up on my proposal to create a Corporate Governance Code for Japan, which became a reality in June thanks to the fine efforts of many others (See Note 2) over many years. We gave a number of seminars (and still are) on the most important aspects of the CG Code, how to approach compliance with it, and the need for companies to produce their own “CG Guidelines” in order to actually have the policies (and substance) they claim they have in TSE governance reports. This was a concept that BDTI (myself) had proposed and promoted from the very start, a year before the CG Code came into effect.

asssa

Our activities last year included producing example CG Guidelines, numerous BDTI seminars or speaking engagements, and a large joint seminar with Mizuho Research (we will have another soon.) These efforts were successful in encouraging approximately 30% of Japanese companies to produce corporate governance guidelines, even thought the quality of many of these still needs to be improved. See the results of this survey.