・Is the “Plan” for Prime Market Transitional Companies Sufficient?

With the reorganization of the TSE market segmentation has started in April, each listed company has disclosed the market it chooses. Of the 1,841 companies currently listed on the TSE 1st Section that have selected the prime market but cannot meet the prime market listing criteria, 296 companies will be allowed to list on the prime market for the time being through “transitional measures.” The main criteria for prime market listing are a ratio of tradable shares of 35% or more and a total market capitalization of tradable shares of 10 billion yen or more. These companies disclose a “Plan” and apply for the transitional measures. The content of that Plan document is to present medium-term numerical targets and describe measures to achieve those targets. In the case of a company with a shortfall in the current tradable share ratio, the main measure is the elimination of cross-held shares. The problem faced by companies applying transitional measures is often the market capitalization of tradable shares, and there is no special remedy for increasing this. As far as the “Plan” is concerned, most of such companies are trying to draw a story of growth of corporate value and enhancement of shareholder returns, which will lead to an increase in market capitalization. Growth in corporate value and enhanced shareholder returns are very important themes for shareholders and investors. Only when the specifics and probability of these measures are in place can sufficient communication with shareholders and investors be achieved. If these measures are approved by shareholders and investors, they will probably bring about a change in valuations. Valuations can be considered to be built-in to the future cash flows of corporate value growth, so solid growth prospects and cash flow allocations should be required. This is true for all listed companies, not just those to which transitional measures apply. In this issue, I would like to explore some tips on how to improve valuations, one of the most important factors in determining market capitalization.

・Explore factors that can be used to enhance valuations

First, we examine which companies tend to have a higher Tobin’s q

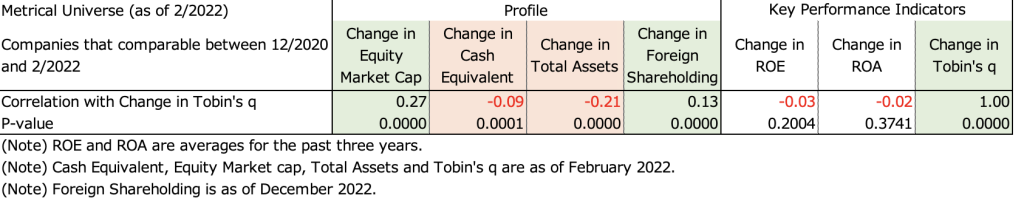

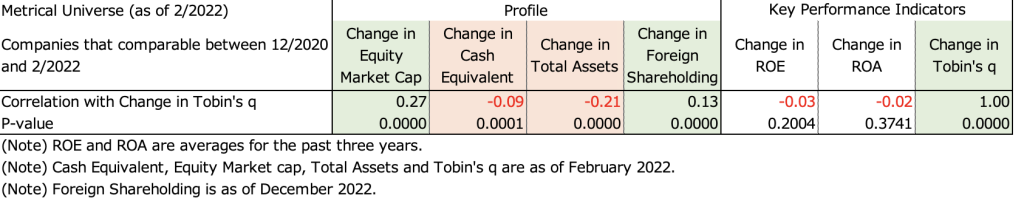

Using the 1,487 comparable companies in the Metrical universe from the end of December 2020 to the end of February 2022, I explore the changes in Tobin’s q and effective factors over the relevant period. The table below shows the correlation analysis between changes in Tobin’s q and changes in the Profile and Key Performance Indicators for the period from the end of December 2020 to the end of February 2022. During this period, changes in Tobin’s q are significantly positively correlated with changes in market capitalization and foreign shareholding ratios. This confirms that changes in Tobin’s q (valuation) are closely related to changes in market capitalization and foreign shareholding ratios. The change in Tobin’s q has also shown a significant negative correlation with the change in cash equivalents and the change in total assets. I find that companies that increased Tobin’s q tended to decrease their cash equivalents and total assets during the period in question.