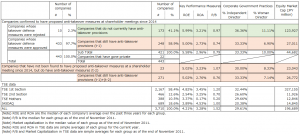

In the previous article, “What Kind of Firm Adopts Takeover Defenses? (Metrical Analysis Using BDTI Data)” we used data from BDTI to analyze the performance and corporate governance practices of companies that have and have not adopted takeover defense measures. The results of the analysis showed that of the 421 companies found to have proposed anti-takeover measures at shareholder meetings since 2014, those companies that have not adopted anti-takeover measures now have superior performance in terms of ROE, ROA, and P/B, as well as in terms of the percentage of independent directors and the percentage of female directors as corporate governance practice metrics.

In BDTI’s data, 443 companies were confirmed to have proposed anti-takeover measures at their shareholders meetings since 2014, of which 10 were rejected and 433 were approved (see table below). As can be seen from the table below, once a takeover defense measure is proposed as an agenda item, it is usually approved. Whether the proposal is approved or rejected depends on the composition of the company’s shareholders, and mainly on the shareholding ratio of foreign shareholders. The TSE’s disclosure document “White Paper on Corporate Governance 2021” also states, “In terms of foreign shareholding ratio, the ratio of companies that have adopted takeover defense measures is lowest in the category of foreign shareholding ratio of 30% or more, at 2.7%, a decrease of 3.7 percentage points from the previous survey. The percentage of holdings in the 20% to 30% category was 9.2%, a significant decrease of 11.1 percentage points from the previous survey. Looking at the relationship with the ownership ratio of the largest shareholder, there was a tendency for the adoption ratio to be higher in the category where the ownership ratio of the largest shareholder is low, while the ratio in the category where the ownership ratio is less than 5% was 13.8%, a significant decrease of 9.5 percentage points from the previous survey.”

As shown in the table below, of the 433 companies that were confirmed to have proposed anti-takeover measures in their shareholder meetings since 2014, 421 are still listed on the stock exchange. Of these companies, 41% (173 companies) do not currently have takeover defense measures, and 59% (248 companies) still have takeover defense measures. As noted above, companies that do not currently have takeover defenses show superior performance and corporate governance practices. Furthermore, in terms of market capitalization, there is a significant difference between companies that do not currently have takeover defenses and those that still do.

BDTI’s data uses AI to search for companies that have proposed anti-takeover measures in their web-based data, so the data published on the web can be easily obtained. However, there are 271 companies that have disclosed in their corporate governance reports that they still have anti-takeover measures, which means that there are 23 companies that were not found in the 248 companies that still have anti-takeover measures according to BDTI’s data above. The reason for the difference in the number of companies is as follows. The reason for this difference in the number of companies may be that not all companies disclose their agenda for shareholder meetings to the TSE or on the relevant company’s website (they only send convocation notices to shareholders in paper form) and that they have not proposed takeover defense measures on their agenda since 2014.

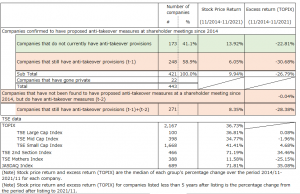

Most of the anti-takeover measures that are proposed as an agenda item at a general meeting of shareholders for approval by shareholders are called advance warning-type rights plans, and the relevant anti-takeover measures are periodically renewed with the approval of the general meeting of shareholders. Therefore, the 23 companies that were not found by BDTI’s AI search may not be required to be approved by the shareholders’ meeting because the timing of the shareholders’ meeting renewal has not yet arrived, or because the company’s articles of incorporation provide for it. If the latter is the case, the situation may be a bit more serious from the standpoint of investors, since takeover defense measures are not a matter for decision by the shareholders meeting. These 271 companies include Nisshin Flour Milling Group Inc. (2202), Nisshin Flour Milling Group Inc. (2801), Eisai (4523), TBS Holdings (9401), and Toei (9605). As you can see in the table below, the “companies that have not proposed anti-takeover measures at a general meeting of shareholders since 2014 but have anti-takeover measures (t-2)” include companies with relatively high P/B in performance and corporate governance practices compared to the other groups. Also, referring to the TSE data in the table below, ROE and ROA cannot be compared simply because those in the TSE data are simple averages of the past three years, while those for companies with takeover defense measures are the median of the past three years’ averages for each company, but P/B and market capitalization can be compared. Compared to the P/B and market capitalization of the TSE 1st Section, those of the companies with takeover defense measures are much smaller companies with lower stock valuations.

The table below shows the stock price performance of each group (5-year stock price return and excess return versus TOPIX). In addition to companies holding takeover defenses, the stock price performance of companies that have proposed takeover defenses at shareholder meetings since 2014 and now hold takeover defenses is inferior to the TOPIX return. During the relevant 5-year period, with the exception of the TSE Mothers Index, the TSE 2nd Section Index and JASDAQ Index returns have outperformed TOPIX returns. The average market capitalization of the 271 companies that still have takeover defense measures is 26,722 million yen, which is smaller than the 327,155 million yen of the First Section of the Tokyo Stock Exchange, but the returns of the Tokyo Stock Exchange Second Section Index and JASDAQ Index, excluding the Tokyo Stock Exchange Mothers Index, are higher than the TOPIX returns. Therefore, it can be confirmed that the stock price performance of 271 companies that still have takeover defense measures has underperformed. It is not that there are an extremely large number of companies listed on the TSE Mothers; the 271 companies include 203 on the TSE First Section, 36 on the TSE Second Section, 26 on the JASDAQ, 5 on the TSE Mothers, and 1 on the NSE Second Section. It is clear that the 271 companies that still hold takeover defenses have underperformed in terms of price performance compared to the TSE Small Cap Index.

This time, we further analyzed companies that still have anti-takeover measures at present. After confirming that the market capitalization of the group of companies in question is relatively small, we compared their 5-year stock price performance with that of each stock index. As a result, we confirmed that the stock price performance of the group of 271 companies that still have takeover defense measures underperformed each stock price index. In my previous article, “Takeover Defense Update,” I hypothesized that many of the companies that still have anti-takeover provisions have small market capitalization, and thus their market capitalization may be expanding at a slower pace. This analysis of stock price performance has confirmed that this assumption is generally valid. I also hypothesized that this is due to a combination of factors, including the company’s lack of a clear growth policy, inability to communicate such a growth policy to investors, and inability to fully utilize IR and other functions. I would like to discuss this in my next article.