SONY (6758) announced a record YEN 455 Billion (US$ 5.7 Billion) loss for financial year 2011, which ended March 31, 2012, and held the annual shareholder meeting on Wednesday.

BBC interviewed me about SONY's prospects – click here to watch the video clip.

My points in the BBC interview are:

Stuck with 1990's structures: SONY's case is representative for many Japanese companies and also for many aspects of Japan as a whole today: SONY grew very rapidly until around 1995, when growth stopped. Since around 1995, there is no growth and averaged over the years zero profit. It's very clear, that many of the management structures and ways of doing things during the pre-1995 rapid growth phase don't work at all any more today.

A commodity maker? SONY needs to decide either to build an attractive ecosystem including attractive high-margin products – such as Apple does – or if SONY continues to shoot for the commodity business, with low margins, then it needs to be No. 1 in that space.

No diversity? in 2012? When we look at SONY's website describing SONY's top management, we can see that SONY's top managers are almost all Japanese men – almost no diversity. SONY's overwhelmingly Japanese male managers know Japan best – so it's no surprise that SONY's best performing division is the Financial Services division: a mainly domestic Japanese consumer credit card and life insurance company.

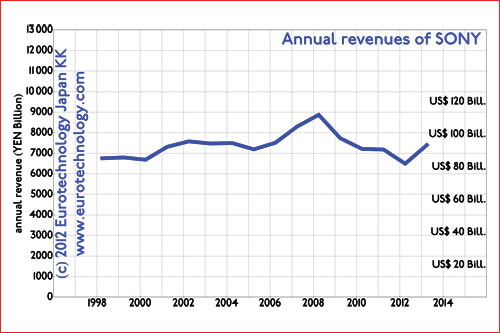

SONY's sales stopped growing in 1998 (about the time the TRINITRON TV patents ran out)….

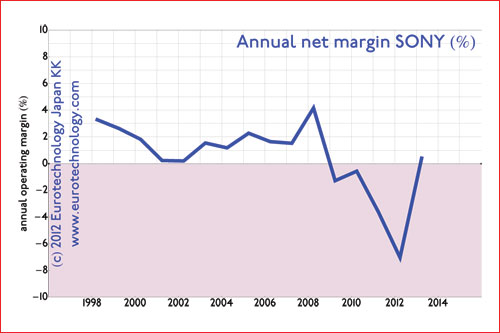

….while net margin and net profits have been around zero with downward trend

More details in our report on Japan's electrical industry sector