Following the previous analysis of the ratio of independent directors, here is an analysis of the ratio of female board members. As you know, the Japanese government has set a target of increasing the ratio of female board members ( board directors, statutory executive officers, and statutory auditors) to 30% by 2030 for companies listed on the prime market. Using data from the Metrical Universe at the end of September, I will examine the characteristics of each group in terms of the ratio of female board members.

Of the 1,781 companies in the Metrical Universe at the end of September, 74 (4.2%) have achieved a ratio of 30% or more female directors. The government and TSE have also set an intermediate goal of appointing at least one female board member by 2025. 1,567 (88%) of the 1,781 companies in the Metrical Universe at the end of September have at least one female board member. The 1,781 companies in the Metrical universe also include companies listed outside the prime market. It also includes companies like Canon that are expected to appoint female board members at future AGMs, so it is likely that the majority of prime market listed companies will have appointed female board members by 2025.

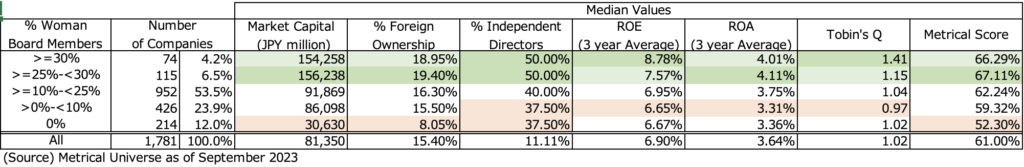

The table below shows the characteristics of the Metrical universe (as of September 30, 2023) by percentage of female directors. The table shows the characteristics of female board members in the Metrical Universe (as of September 30, 2023) by the ratio of female board members in five groups: 30% or more, 25% to 30%, 10% to 25%, 0% to 10%, and 0%, and the market capitalization, ratio of foreign shareholders, ratio of independent directors, ROE, ROA, Tobin’s Q, and Metrical Score (overall corporate governance rating). -The following table shows the overall rating for each of the five groups.

This shows that the 30%+ and 25%-30% groups have excellent and very close numbers in each category. The group of companies with more than 25% – less than 30% female directors is expected to increase their ratio of female directors to 30% or more in the very near future and includes companies that are also highly aware of corporate governance practices. As an indication, the median independent director ratio for the 25%-30% group is 50%, the same as for the 30%+ group. In the Metrical Score, which indicates the overall rating of corporate governance, the group with more than 25%-30% female directors slightly outperforms the group with more than 30% female directors. In terms of Tobin’s Q, the groups with 30% or more female board members and the groups with 25%-30% or more female board members outperformed the other groups in terms of ROE and ROA. In terms of Tobin’s Q, the groups with 30% or more female board members and the groups with 25% to 30% female board members both outperform the other groups, but the group with 30% or more female board members is by far the highest.

Next, looking at market capitalization and the ratio of foreign shareholders, we see that the groups with a female board member ratio of 30% or more and the groups with a female board member ratio of 25% – 30% contain companies with large market capitalizations, which differ from the other groups in terms of market capitalization. The ratio of foreign shareholders is also high for the groups with 30% or more and the groups with 25% – 30% or more female directors, indicating that the ratio of female directors tends to be high for companies with large market capitalization that are the target of investment by overseas investors. Since the group with a 0% ratio of female board members has by far the smallest market capitalization and an extremely low ratio of foreign shareholders, the data confirms that the ratio of foreign shareholders has a significant bearing on the increase in the ratio of female board members. On the other hand, when we look at the ratio of foreign shareholders, we find that the ratio of foreign shareholders is high even in the groups where the ratio of female board members is between 10% and 25% and between more than 0% and less than 10%, so we expect that the ratio of female board members will gradually increase in line with the aforementioned government and TSE targets, aided by the engagement of overseas investors.

The group with 0% female board members has slightly higher ROE, ROA, and Tobin’s Q than the group with more than 0% and less than 10% female board members, and thus is not inferior to the group with more than 0% and less than 10% female board members in terms of profitability and stock price valuation. However, no female directors are appointed. The group with 0% female directors has the same ratio of independent directors (37.50%) as the group with more than 0% and less than 10% female board members, but has by far the lowest Metrical Score (overall evaluation of corporate governance). This suggests that the group with a 0% ratio of female board members was responding to items in the Corporate Governance Code, such as the explicit statement that “Prime market listed companies should have a ratio of independent directors of at least 1/3”, but was not interested in essentially improving its corporate governance practices in the first place. It is believed that (the ratio of female board members was also not explicitly stated as a government or TSE policy until this year). Therefore, while the ratio of female board members may be gradually raised in line with the government and TSE policies in the future, we can assume that it will only be a numerical adjustment and that no substantive improvement can be expected.

Finally, let us consider once again with respect to Tobin’s Q. The group of companies with more than 30% female board members shows slightly lower values for market capitalization, foreign shareholder ratio, ROA and Metrical Score than the group with more than 25%-30% female board members, but noticeably higher values for ROE and Tobin’s Q. The group with more than 30% female board members has a slightly lower ROA than the group with more than 25% – less than 30% female board members, while it is by far the best in ROE, and dominates in Tobin’s Q (stock price valuation). The overwhelming Tobin’s Q difference should be based on ROE. It should be considered that the high stock price valuation is the result of investors’ evaluation of appropriate capital allocation, including shareholder returns. Companies that have already achieved a ratio of 30% or more female board members should be viewed positively as having improved their practices in the essential sense that the appointment of empathetic board members is important in carrying out a stock company’s goal of expanding corporate value, rather than just matching numbers. Since the TSE’s request to raise the P/B, there has been a lot of attention paid to the P/B. The key to raising the stock price valuation is improving the profitability of ROA to raise ROE and proper capital allocation. At the same time, we are reminded of the importance of essential policies leading to corporate value growth to carry out shareholder company goals.

In summary, I have considered the above based on the percentage of female board members of the 1,781 companies in the Metrical Universe at the end of September.

The groups with more than 30% female board members and those with 25%-30% female board members have superior market capitalization, profitability, stock price valuation, independent director ratio, and corporate governance ratings. Groups with more than 30% female board members have already achieved this goal before the government and TSE set a target of increasing the percentage of female board members to 30% or more by 2030, which was announced in July of this year. Groups with more than 25% – less than 30% female board members are also expected to increase the percentage of female board members to 30% or more in the very near future, and are likely to include companies that are also highly aware of corporate governance practices. We surmise that the driver of this increase is still due to overseas investor engagement. The groups with more than 30% female board members and more than 25% – less than 30% show high foreign ownership, which is supported by the fact that those two groups include companies with large market capitalization in which they invest.

Conversely, the group with 0% female board members includes many companies with low foreign shareholder ratios and small market capitalization. This group includes many companies that are not listed on the prime markets targeted by the government and TSE targets. And while these companies may achieve the government’s and TSE’s interim goal of appointing one female board member by 2025, the fact that they have yet to appoint a female board member suggests that they have little interest in improving their corporate governance practices.

Both the group with more than 30% female board members and the group with more than 25%-30% female board members have superior values in each category compared to the other groups. However, the group with more than 30% female board members has a noticeably higher Tobin’s Q than the group with more than 25%-30% female board members. This can be attributed to their higher ROE. The group with more than 30% female board members has a higher ROE than the group with more than 25%-30% female board members, even though their ROA is lower. This is the reason why investors have a high opinion of the company’s stock price.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/