Nominating committees are the most difficult issue in corporate governance practices. Since the election (nomination) of directors is a matter that involves personnel rights, and personnel is also a matter that has a great deal to do with compensation, the CEO is still deeply involved in this decision in many companies, especially in Japan where the board of directors is composed of many inside directors. It is not difficult to imagine that there would be resistance to delegating this decision-making authority to independent outside directors. To conclude, even if a nominating committee has been established, it is impossible to know whether the committee is functioning properly without a close examination of the substance of the committee. In order to check whether the nominating committee is functioning properly, the first point to be considered is whether the majority of the members of the committee are independent outside directors, and whether the committee is chaired by an independent outside director. However, a prerequisite for this is that the board of directors must be prepared to accept decisions on director nominations made through a transparent and objective process. This can be thought of as the board of directors itself being operated in a transparent and objective manner. As a measure of this, I would like to examine whether independent outside directors make up the majority of the board of directors. If the board of directors is dominated by inside directors, it is unclear whether the process of nominating directors is carried out in a transparent and objective manner, and it is also unclear whether the board of directors approves the proposed candidates for directors submitted by the nominating committee.

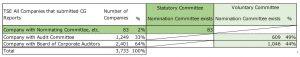

First of all, as shown in the table below, the current status of the nominating committees of all listed companies in Japan is as follows: of the 3,733 companies that submitted corporate governance reports out of the 3,784 companies listed on the Tokyo Stock Exchange as of October 1, 2021, 82 companies (2% of the total) are companies with nominating committees under the law. (2% of the total). There were 1,249 companies with audit committees and 2,401 companies with board of corporate auditors, of which 609 companies (49%) and 1,046 companies (44%) had voluntary nominating committees in their respective organizational forms.

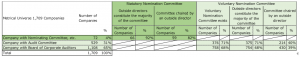

To check whether the nominating committee is functioning properly, the table below shows the membership of the nominating committee in the Metrical Universe (September 2021) to find out whether independent outside directors constitute the majority of the committee members and whether an independent outside director chairs the committee. In the 1,709 companies in the Metrical Universe, there are 72 companies with nominating committees, of which 66 (92%) have a majority of their nominating committees chaired by outside directors, and 59 (82%) are chaired by outside directors. In contrast, those ratios are lower for voluntary nominating committees of companies with audit committees and companies with corporate auditors. Among Universe’s 529 companies with audit committees, 376 (71%) have voluntary nominating committees, 375 (71%) have a majority of outside directors on the committee, and 214 (40%) are chaired by outside directors. Among Universe’s 1,108 companies with auditors, 758 (68%) have voluntary nominating committees, 754 (68%) have a majority of outside directors on their committees, and 430 (39%) are chaired by outside directors.

Also, as I mentioned at the beginning of this article, I believe that the proper functioning of the nomination committee requires that the board of directors itself emphasizes a transparent and objective nomination process, and that the board of directors itself is operated in a transparent and objective manner with a focus on independent outside directors. As one measure to verify whether the board of directors itself is operated transparently and objectively with independent outside directors at the center, I will use whether independent outside directors constitute a majority of the board of directors and verify this together with the nomination committee score.

The table below shows the percentage of companies with independent outside directors on the board of directors, the number of companies with a majority of independent outside directors on the board of directors, and the percentage of companies with a majority of independent outside directors on the board of directors for each scoring criteria of the nomination committee by organizational form. In the highest score of 3, “Outside directors constitute the majority of the members of the nominating committee and outside directors serve as the chairman of the committee,” outside directors constitute the majority of the board of directors at 41 companies with a nominating committee, 69% of the 59 companies with a score of 3. On the other hand, in companies with an audit committee, outside directors make up the majority of the board of directors in 29 companies, or only 15% of the 197 companies that scored 3. For companies with board of corporate auditors, only 19 companies, or 6% of the 306 companies with a score of 3, have a majority of their board of directors composed of outside directors.

In other words, in companies with nominating committees, etc. that have nominating committees under the law, 69% of the companies where “outside directors constitute the majority of the members of the nominating committee and an outside director serves as the chairman of the committee” are expected to operate in a way that ensures transparency and objectivity in the process of nominating directors. In the case of companies with audit committees and companies with board of corporate auditors that have voluntary nominating committees, the nomination process for board members includes a majority of independent outside directors on the board. It is unclear whether transparency and objectivity are ensured in the operational processes of the Board of Directors and the Nominating Committee, with a focus on independent outside directors.

This analysis shows that in 69% of the companies with a nominating committee, etc., where the nominating committee has a system to ensure transparency and objectivity in that “outside directors constitute the majority of the members of the nominating committee and an outside director serves as the chairman of the committee,” the percentage of outside directors on the board of directors exceeds 50%. This confirms that shifting to a company with a nominating committee, etc., where a statutory nominating committee is established, is a powerful way to ensure the proper operation of the nominating committee. In other organizational forms, the percentage of outside directors on the board of directors is still above 50% in only a limited number of companies that have a system to ensure transparency and objectivity in that “outside directors constitute the majority of the members of the nomination committee and the outside director serves as the chairman of the committee. There are still only a limited number of companies where the ratio of outside directors on the board exceeds 50%. Even if a nominating committee has been established, it is necessary to examine the percentage of independent outside directors on the board of directors in conjunction with the structure of the committee and keep in mind the risk that it will not operate properly.

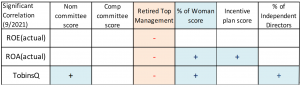

In addition, the table below shows the ROE (actual), ROA (actual), and Tobin’s Q performance indicators for each criterion of whether outside directors constitute the majority of the nominating committee members and whether the committee is chaired by an outside director.

In my previous post, I mentioned that there is no regularity between nominating committee scores and performance indicators. However, for the first time in the Metrical Universe September 2019 data, a significant correlation has been found. This is the first time in five years that a significant positive correlation has been found (negative correlations have been seen several times in the past). The table below shows the correlation between the scores of the nominating committee and other performance indicators. A significant positive correlation between Tobin’s Q and the percentage of independent directors on the board has been identified before. And, as mentioned above, in companies with nominating committees, most of the companies with high nominating committee scores “where outside directors constitute the majority of the members of the nominating committee and outside directors serve as the chairman of the relevant committee” also have more than half of the outside directors on the board of directors. Therefore, it is not surprising to see a positive correlation between nominating committee scores and Tobin’s Q. In the future, this correlation will continue to be confirmed as more and more companies transition to companies with nominating committee etc. If the correlation between transitioning to a company with a nominating committee and high stock price appreciation becomes established, it will be an incentive for listed companies to transition to a company with a nominating committee etc.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/