In January 2024, Japanese stocks rose sharply as overseas investors bought Japanese stocks for the first time since June 2023. There has been no change in the composition of Japanese equities driven by overseas investors, who account for over 70% of the TSE’s trading volume. Meanwhile, since the TSE’s request at the end of March 2023, listed companies have been struggling to raise their stock price valuations (P/B). We have also seen an increase in disclosures from listed companies that seem to be expecting overseas investors to buy their shares. In this article, we will focus on the ratio of foreign shareholdings and analyze the trends in companies in which overseas investors invest. The contents of this article should be of interest not only to overseas investors, but also to listed companies.

The Metrical universe of 1,822 companies (as of January 2024) is divided into five groups (30% or more, 20% or more but less than 30%, 15% or more but less than 20%, 10% or more but less than 15%, and less than 10%) based on foreign shareholding ratio and analyzed for each category. The median foreign shareholding ratio is 15%; companies with 15% or more can be said to have higher foreign shareholding ratios. Also, as discussed in my previous article “Takeover Defense Measures and Foreign Shareholder Ratio,” there is a sort of threshold at 30%. When the foreign shareholding ratio exceeds 30%, it becomes more difficult for the company to secure 1/3 of the special resolution at the shareholders’ meeting, and thus the influence of foreign shareholders becomes stronger, which in turn can be expected to improve the company’s management.

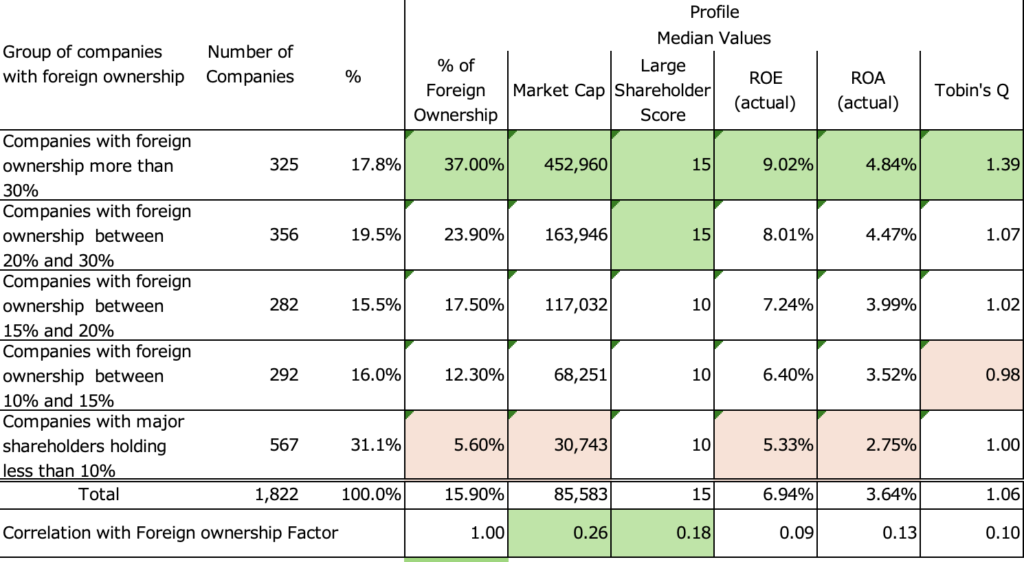

The table below profiles the Metrical universe of 1,822 companies (January 2024), divided into five groups (30% or more, 20% to 30%, 15% to 20%, 10% to 15%, and less than 10%) by foreign ownership. Companies with a foreign ownership ratio of 30% or more invest in companies with by far the largest market capitalization. And those companies can be said to have high ROE and ROA. As institutional investors, overseas investors invest in companies with high liquidity and high profitability. As a result, market valuations (stock price valuations) are high. Another characteristic is the tendency to avoid investing in listed subsidiaries of parent and subsidiary companies, as indicated by the Large Shareholder Score (a high score indicates that there are no large shareholders holding more than 20% of the shares). Companies with foreign shareholdings between 20% and 30% also tend to be somewhat similar to those with foreign shareholdings of 30% or more. Conversely, companies with lower than median foreign shareholding ratios (less than 15% foreign shareholding ratio) have smaller market capitalization, have large shareholders holding more than 20% ownership, and include companies with lower ROE and ROA and lower Tobin’s Q. Since the correlation coefficients with the foreign ownership ratio are higher for market capitalization and major shareholder score, it appears that overseas investors consider these two factors important when investing in a company.

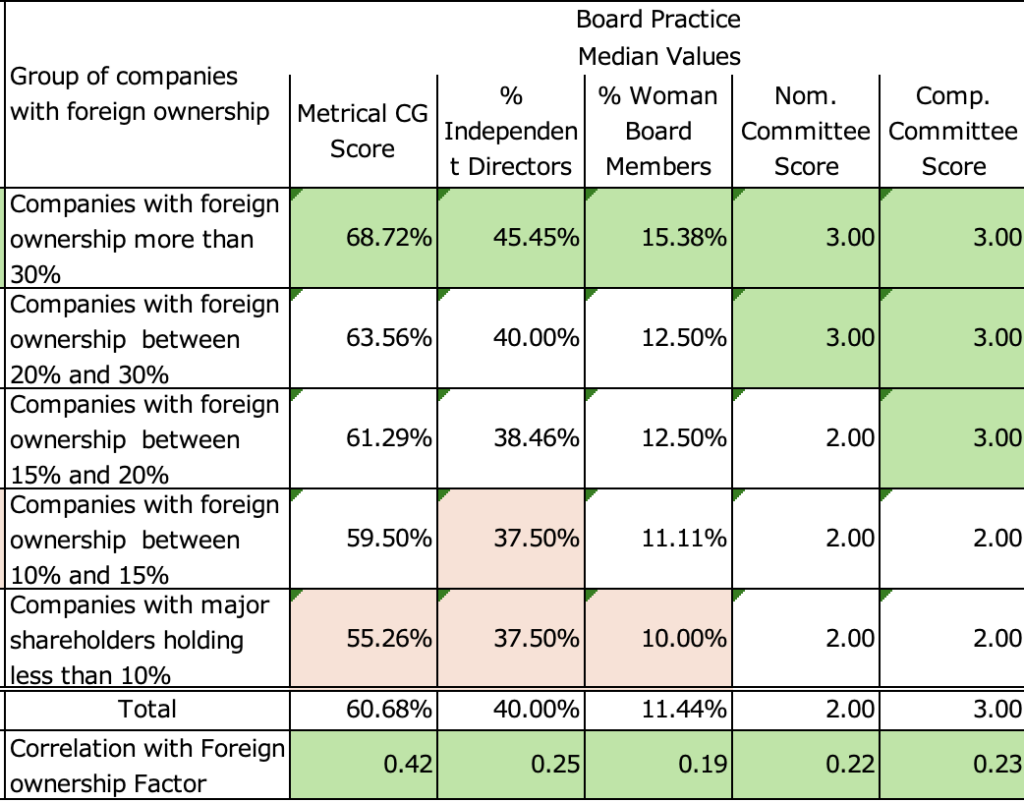

The table below shows the characteristics of board practices in five groups of foreign ownership percentages. Board practices also confirm the remarkable results. Companies with foreign shareholdings of 30% or more show significantly superior values. Companies with foreign shareholdings between 20% and 30% also show generally superior values, followed by companies with foreign shareholdings of 30% or more. Conversely, companies with foreign shareholdings below the median (less than 15% foreign shareholdings) also have poor Board Practice values. It seems safe to assume that board practices tend to improve as the foreign shareholding ratio increases and the influence of overseas investors increases. In this sense, it reaffirms the significant role played by overseas investor engagement in improving corporate governance.

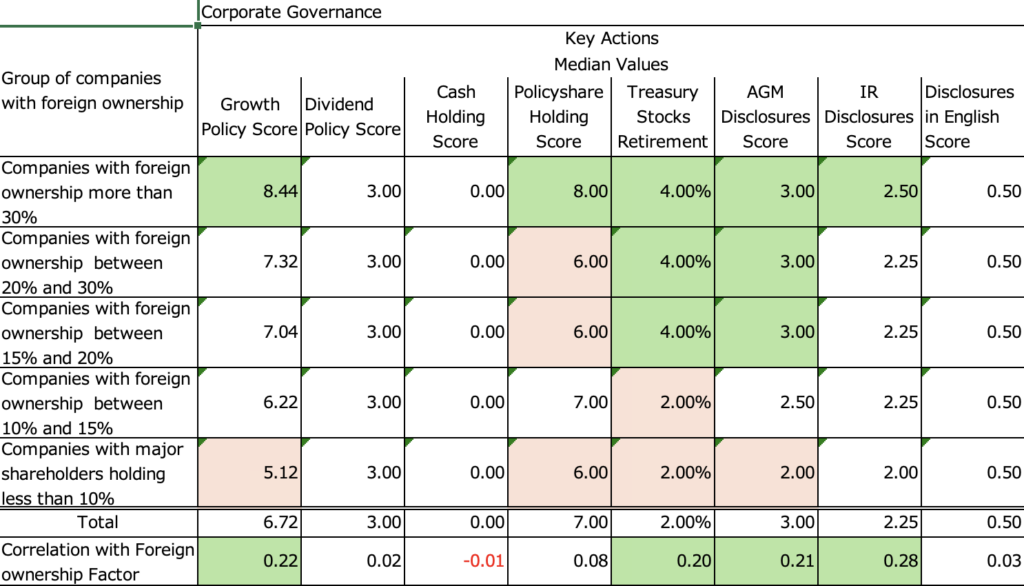

The table below shows the characteristics of Key Actions in five groups of foreign shareholding ratios. Companies with foreign ownership of 30% or more also have superior values in the Growth Policy Score, Policieshare Holding Score, Treasury Stocks Retirement, AGM Disclosures Score, and IR Disclosures Score for the key actions. Since the median values of the Dividend Policy Score and Cash Holding Score are the same for all groups, it can be said that all listed companies tend to have extra cash on hand and many of them are based on stable dividends. On the other hand, companies with foreign shareholdings of 30% or more have a better Policy Holding Score than the other groups, indicating that the engagement of overseas investors will help them reduce their policy holdings. For Treasury Stocks Retirement, the same values are shown for firms with foreign shareholdings of 15% or more, indicating that share repurchases and cancellations have penetrated firms with a median foreign shareholding of 15% or more. On the other hand, it is interesting to note that Disclosures in English Score remains unchanged for both groups. Since TSE will require prime market listed companies to disclose in English from April 2025, this indicates that although many companies have translated their financial statements into English, many have yet to do so for other documents. As the quality and quantity of Disclosure in English increases in the future, it may appear as a difference in the ratio of foreign ownership.

In summary, by dividing companies into five groups based on the percentage of foreign ownership, I have tried to determine the characteristics of the companies in which overseas investors invest and what trends in corporate governance these companies have.

The Metrical universe of 1,822 companies (January 2024) was analyzed by dividing them into five groups (more than 30%, more than 20% and less than 30%, more than 15% and less than 20%, more than 10% and less than 15%, and less than 10%) by foreign shareholding ratio.

With regard to the type of companies overseas investors tend to invest in, they invest in companies with large market capitalization and high profitability. This results in higher stock price valuations. Another characteristic is that they tend to refrain from investing in listed subsidiaries of parent-subsidiary listings.

Next, with regard to the characteristics of board practices of firms with high foreign shareholding ratios, firms with foreign shareholding ratios of 30% or more show significantly superior values. Since companies with foreign shareholdings between 20% and 30% also generally show superior values, it seems reasonable to assume that board practices improve as the influence of overseas investors increases as the foreign shareholding ratio rises. It can be said that the engagement of overseas investors contributes significantly to the improvement of corporate governance.

Finally, with regard to the key action characteristics of firms with high foreign shareholdings, companies with foreign ownership of 30% or more have superior values in the Growth Policy Score, Policyshare Holding Score, Treasury Stocks Retirement, AGM Disclosures Score, and IR Disclosures Score. It is expected that engagement by overseas investors will lead to a reduction in policy shareholdings. Treasury Stocks Retirement seems to have penetrated listed companies to a certain extent, but in terms of shareholder returns, there are issues for all companies in cash allocation, as many companies are based on stable dividends and have excess cash on hand. In addition, while there is still no difference in the ratio of foreign shareholders in English disclosure, the TSE has requested disclosure in English from April 2025, so the quality and quantity of disclosure may make a difference in the ratio of foreign shareholdings in the future.

Aki Matsumoto, CFA

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/