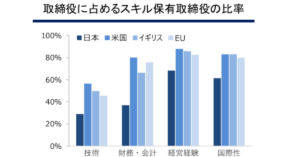

Take a look at the chart below, from materials recently published by the FSA’s Committee on the Stewardship Code and the Corporate Governance Code. This is from an analysis of ALL directors (both executive and non-executive) at TSE1 firms that disclosed a skills matrix in 2019. From left to right, the categories are: a) technology; b) finance and/or accounting; c) executive management experience; and d) global (international) experience. Can you guess which country is the dark blue bar? Yep, that low guy is Japan. Right across the board.

There are alarming skills deficits on Japanese boards, especially in finance and accounting. It is scary, when you consider that the board you are sitting on is approving the financials each quarter. In fact, the most common feedback that The Board Director Training Institute of Japan (BDTI) gets in post-course surveys is a comment like, “Thanks, I learned a lot of essential things. Most of all, I realized how little I understand finance, and how much more I have to study it.” Even though we teach about finance topics for almost three hours in our first-level course, we are only scratching the surface because the average level of knowledge of participants is so low. This is the reason why BDTI is now designing a longer, intensive course focusing on finance for directors. (Please contact us if you are interested. )

One reason Japanese boards don’t have as many persons who understand technology could be because they give a larger percentage of their outside board seats (than in other countries) to lawyers, accountants, and academics. Moreover, even though almost 65% of outside directors are persons coming from senior management backgrounds, they very often hail from completely different industries, so do not understand technologies related to the company in question. (This creates an “asymmetry of information problem”. Deep down, executives may prefer those persons as outside directors precisely because they are unlikely to be able to question management’s decisions. )

But the biggest reasons for the skill/experience gaps you see in the chart is that so many board seats are given to executive directors. These persons are normally in the majority, and they rose through the ranks of a limited number of vertical silos and did not receive training about the other silos. Having so many “insider” executive directors means: a) we can’t possibly have as many persons with top management experience, since out of the majority of executive directors, obviously only one, two or maybe three will have had a very senior post at the company in questions. Stating the obvious, unlike a US or European board, we can’t possibly have as many persons with senior (CEO, CFO, or COO) experience at other companies, because we have so few directors from other companies.

Another reason for the gaps, is that most companies still prohibit their executives from sitting on other companies’ boards (兼務の禁止). Unlike in other countries, where companies might think for Mr./Ms. X to serve as an outside director might round out that executive’s experience base and give him or her perspectives that might help his/her own firm later on, Japanese companies take the position that “we are not paying our executives to work for someone else and make more money than the rest of us.”.

Off course, all of this points to the obvious needs to:

- loosen up constraints on taking director jobs at other companies;

- devote more time and expenses to training managers about finance, earlier in their careers

- have executives and outside board members swallow their pride and receive much more serious, in-depth director training

- have internal executives also do so at an earlier stage – i.e. before asking shareholders to vote for them;

- increase the number of independent outside directors, especially those who don’t mind refining or adding to their skills; and

- add more foreigners to Japanese boards.

As you can see, to just focus on training for outside directors, as METI and FSA seem to be doing now, is to only focus on 35% of the problem, or even less: the group of directors who do not control the board, and usually do not think they need training or want to admit it. The outside directors are also the group who are hardest to train before asking shareholders to vote for them. There is not much time before the AGM, and many outside director candidates would be a bit insulted if they were asked to attend a training course, even if paid. In contrast, a company can simply order internal executives to get training.

The reality is that each board is a team, and its members need to have both diversity as well as minimal “director” skills, in order o function well. The best boards are those with the humility to: a) get training for the whole board together, with an open mind to new topics, and b) make director training for executive officers a mandatory internal requirement, and publicize that policy.

Nicholas Benes