The solid U.S. stock market, which has settled down from last month’s financial system unrest, led Japanese stocks to move higher toward the end of the month.

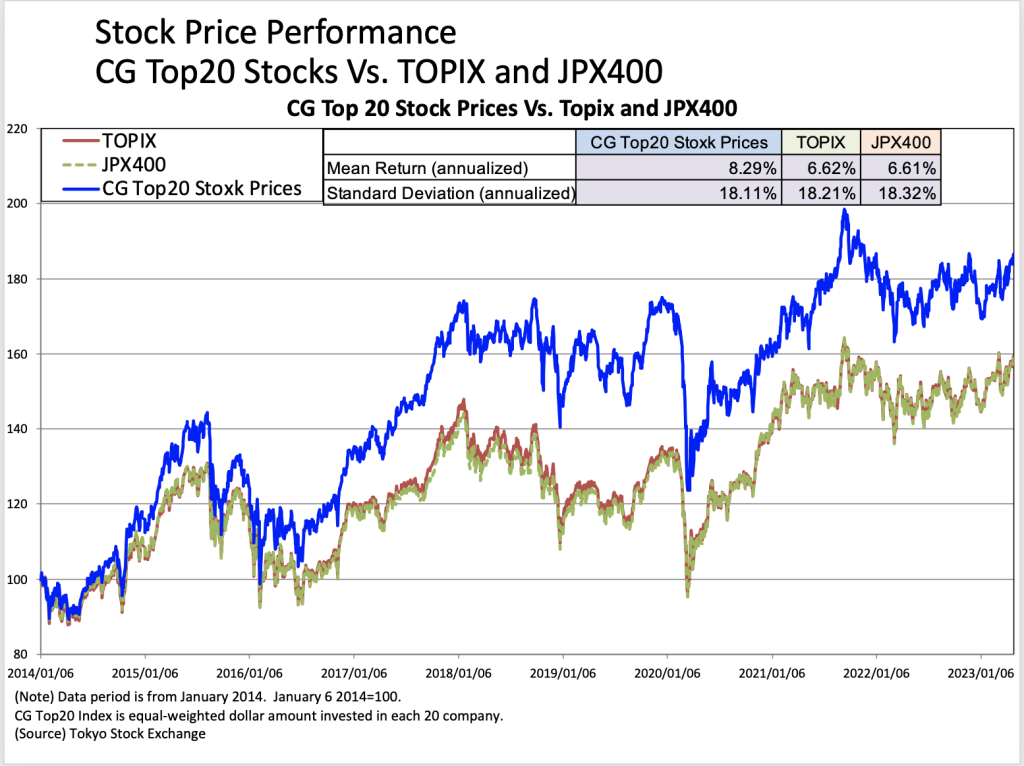

The CG Top20 stock price index significantly outperformed both TOPIX and JPX400 for the second consecutive month.

The stock market rallied toward the end of the month on the strength of U.S. stock prices as U.S. stocks gradually calmed down from the financial system unrest triggered by the failure of the Silicon Valley Bank in the U.S. On the last day of the month, the Bank of Japan’s monetary policy meeting maintained monetary easing, and stock prices rose sharply.

The TOPIX and JPX400 indexes gained 2.71% and 2.58%, respectively, in April, while the CG Top20 stock index outperformed both indexes for the second consecutive month with a 3.06% gain.

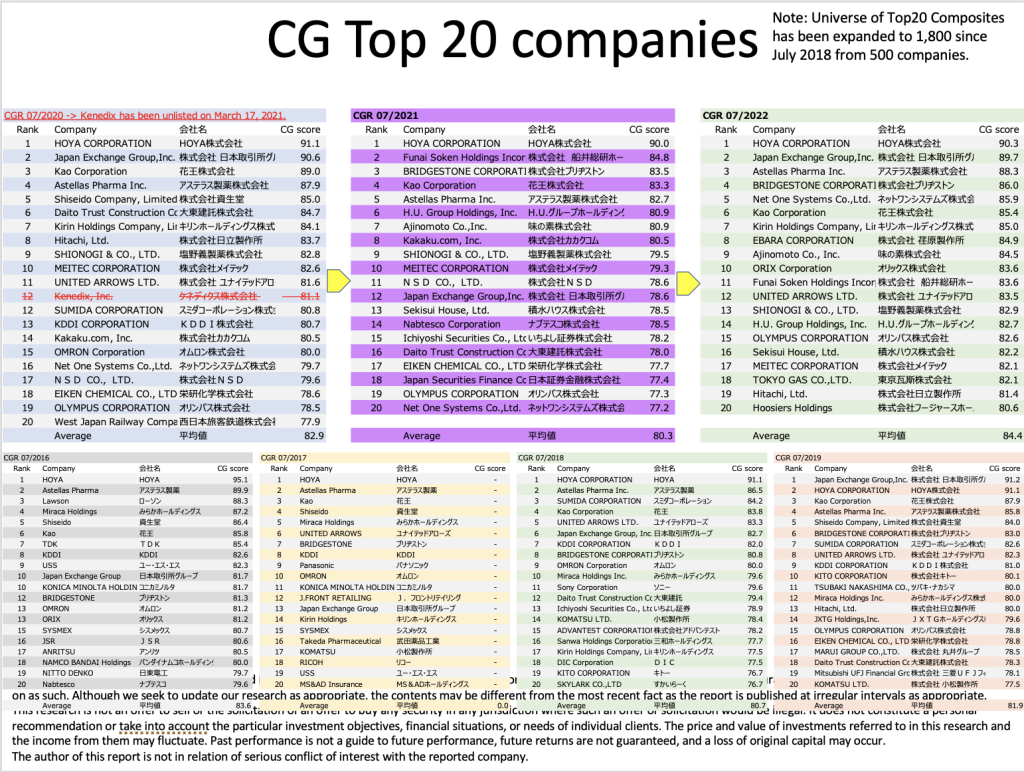

Over the long term since 2014, the CG Top20 stock price has continued to outperform both indexes by about 2% per year and lower volatility than the market indexes. The CG Top 20 has been reassessed as of July 1. The table below shows the new components.

Please see detail in the following link.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/