We are planning to hold the next course on September 7th(Tue) & November 18th (Thur) 2021. Sign up early! Please see a description of our director training course here or click the button below for further information.

Make a new forum entry

| Next Director Boot Camp is January 31st! |

We are planning to hold the next course on September 7th(Tue) & November 18th (Thur) 2021. Sign up early! Please see a description of our director training course here or click the button below for further information.

Recently, awareness of ESG (or SDGDs) is spreading among the society and stakeholders surrounding companies. There are more and more opportunities for companies to introduce their ESG initiatives in analyst meetings, CSR reports, and integrated reports. It is a good thing to deepen the understanding among society and all parties concerned. More and more listed companies are giving presentations on their ESG initiatives at analyst meetings to explain their financial results, following their financial reports and outlooks. In this context, I have some questions. One of them is that not a few companies are focusing on BCP (Business Continuity Plan) as their G (Governance) initiative. Secondly, as part of their S (Social) initiatives, they are focusing on social contribution activities. This time, I would like to discuss the latter S.

It seems that there are many listed companies that feel that S (Social) is somewhat obscure when they come into contact with the ESG reports of companies on a daily basis. As mentioned above, we often see cases where companies introduce their social contribution activities or efforts to improve the working environment (e.g., work-life balance, childcare and family leave programs) as examples of their S initiatives. Of course, such individual efforts are included in the S (Social) category, but I feel that for the sustainable growth of companies, we should pay more attention to the improvement of the social environment from a broader perspective. Companies are engaged in corporate activities in a society where people are related to each other in various positions. In order to promote the smooth operation and sustainable growth of corporate activities in such a society, I think it would be a good idea to communicate that the company is managing its business from the standpoint of respecting human rights from a broad perspective.

Some companies that have taken the lead in ESG initiatives are now expressing their basic stance on human rights. I think it is easier for many people to understand if they follow this basic approach to human rights and refer to individual initiatives. Many of the companies that take this approach are large companies with global operations. This is probably because they understand that understanding and respecting diversity and people’s rights is essential for conducting business, and that this will reduce business risks. However, many Japanese companies don’t take this approach and express their views on “human rights”, but only describe individual initiatives such as those mentioned above in their reports.

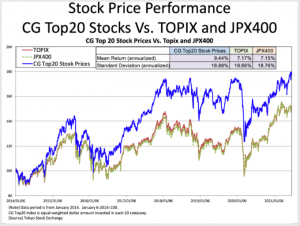

As in the previous month, June stock market continued directionless trading and closed slightly higher in thin trading. The CG Top 20 significantly outperformed both the Topix and JPX400 indices.

Despite a temporary decline in the second half of the month, the stock prices continued to lack a sense of direction due to low trading volume and lack of material to take hold of throughout the month.

The Topix and JPX400 indices rose 1.17% and 0.82%, respectively, during the month of June, while the top 20 CG rating score stocks outperformed for the third consecutive month at 3.50%.

The CGTop 20 stocks composites will be reviewed at the end of June each year, and their performance will be measured using the new components from July 1.

The Board Director Training Institute of Japan (BDTI) is pleased to welcome Eiji Hirano to its board of directors, effective as of July 1st, 2021.

Until April of this year, Mr. Hirano served as the first Chairperson of the Board of Governors of the Government Pension Investment Fund of Japan (GPIF), which is the world’s largest national pension fund with approximately USD1.62 Trln (178 Trln Yen) under management. During his time as Chair, Mr. Hirano stressed the importance of corporate governance as one of the essential pillars of ESG at both portfolio companies and the GPIF itself. He led the GPIF’s board in overseeing management of its massive portfolio during a time of accelerating change, a global pandemic, and growing world-wide recognition of the need for greater corporate sustainability.

Mr. Hirano’s career has spanned economics, international financial markets, investment, public policy and corporate governance, and he has a Master’s degree in Economics from Harvard University. In addition to his recent experience at the GPIF, Mr. Hirano brings to BDTI a wealth of perspectives gained from his distinguished career at the Bank of Japan, where he stepped down as an Assistant Governor at 2006, and other positions in the private sector. Currently, he serves as the non-executive Vice-Chair of MetLife Japan, and as an outside director at NTT Data and Riken. He is also an auditor at the Keizai Doyukai and a member of Japan UNESCO‘s domestic committee.

Commenting on Mr. Hirano’ appointment, BDTI Representative Director Nicholas Benes said, “we are honored and excited that Mr. Hirano has joined our mission to improve the effectiveness of boards by providing practical, high-standard directorship training programs.” Echoing his sentiment, fellow Representative Director Kenichi Osugi (Professor of Law at Chuo University) said, “Mr. Hirano’s broad range of experience will help us better prepare board members for what faces them in the future.”

Mr. Hirano said, “the success of sustainable investment depends largely on the quality of boards and corporate governance, and the best way to meaningfully improve those things is through new knowledge, sharing of “best practices”, and discussion, — all the things the director training entails. Therefore, director and governance training are essential for society. We need to tirelessly convey this reality to those asset managers that are adopting ESG and impact investing techniques, but may be uncertain as to how they can make a more direct contribution to overall sustainability. I am hoping to encourage more domestic institutions to support BDTI’s activities.”

The next Boot Camp will be on Tuesday, July 13, 2021. Course will be on ZOOM, so anyone in the world can join. Make sure to sign up now! This one-day intensive program teaches participants key legal and corporate governance knowledge they need to responsibly serve on, report to, or analyze boards of Japanese companies, both public and private. The course consists of short lectures interspersed with time for interactive discussion and Q&A about real-life situations that occur on boards, and how to handle them. The course is usually good fun for everybody, since we learn from each others’ experiences, as well as from BDTI. The course covers topics such as:

The next Boot Camp will be on Tuesday, July 13, 2021. Course will be on ZOOM, so anyone in the world can join. Make sure to sign up now! This one-day intensive program teaches participants key legal and corporate governance knowledge they need to responsibly serve on, report to, or analyze boards of Japanese companies, both public and private. The course consists of short lectures interspersed with time for interactive discussion and Q&A about real-life situations that occur on boards, and how to handle them. The course is usually good fun for everybody, since we learn from each others’ experiences, as well as from BDTI. The course covers topics such as:

May stock market continued directionless trading after an upturn at the beginning of the month. CG Top 20 stocks outperformed against both the Topix and JPX400 indices.

Stock prices opened higher at the beginning of the month on the back of lower US interest rates led by lower-than-expected US employment data, but subsequently kept directionless trading. Topix and JPX400 indices gained 1.42% and 1.78%, respectively, during the month of May. The CG Top 20 stocks outperformed for the second consecutive month with a 2.17% gain.

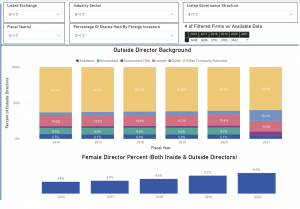

We have long considered the number of female directors as one of the key factors in board practices to measure how a company is willing to change, and according to the BDTI survey (3,622 companies as of March 26, 2021), the percentage of female directors on boards has improved significantly from 1.4% in 2016 but still only accounts for 6% of the total (see chart below).

Metrical’s survey of the universe companies, mainly those listed on the Tokyo Stock Exchange 1st section, also shows how few female directors there are (see chart below). Of the 1,729 listed companies in the universe, 643 (37.2% of all universe companies) have no female directors, 676 (39.1%) have one female director, and only 410 (23.7%) have two or more female directors.

Stock markets ended the month of April in a downtrend, mainly due to concerns about the spread of a COVID-19 infection. The performance of the CG Top 20 stocks over the month outperformed the Topix and JPX400, limiting the decline. In April, the stock market closed lower as traders took stock of their positions before […]

Over the past six years Japan has put in place a long list of corporate governance reforms, amounting to a virtual revolution in thinking at corporations, domestic institutional investment firms, and even society. However, because Japan is still only halfway through the “tunnel” of reform and thinking, much of the resulting value creation for investors and other stakeholders is yet to come. Key takeaways from this whitepaper’s data-driven review of Japan’s governance “revolution” include:

Tangible corporate governance reform has come to Japan, in the form of a robust Corporate Governance Code and Stewardship Code.

In tandem with government policy, advocacy by investor groups and pro-governance corporate leaders will continue these positive reforms in the years to come.

Japanese firms have “got the message” that a sea change has occurred: a majority of firms are hiring outside directors, establishing nominations and compensation committees, and reducing takeover defenses such as poison pills.

Japanese boards are starting to embrace global trends for incentive-based compensation, higher levels of diversity, and focus on returns and capital efficiency.

Cross-shareholdings and other “allegiant holdings” are being unwound as foreign and domestic institutions alike have become more proactive in their proxy voting strategies, making the market more attractive in general.

Merger and Acquisitions (M&As) and activism are on the rise, raising capital efficiency or managerial awareness of the need for it.

As a result of many of the above changes, Return on Assets (ROA) values in Japan are trending higher across the board.

We will be closed from May 1st to May 9th due to the consecutive national holidays as the Golden Week Holidays.

Business will resume on Monday, May 10, 2021.

We apologize for the inconvenience and thank you for your kind understanding.

Please feel free to leave us a message at the e-mail address below, and we will get back to you shortly.